Note: This article has been revised from its original version after several questions had been raised about the data and the analysis. First Key would like to thank Dr. Bart Watson, Chief Economist of the Brewers Association, for providing key data inputs for the analysis.

“Can Inventory Running Low Nationwide.“

“Can Shortage Has Industry Crying in Its Beer.“

“Can Shortage Advisory: Can manufacturers are reported to be operating at capacity with no quick or easy way to increase production.“

Recent months have seen these headlines, respectively, in beer industry trade publication Brewbound, in the Wall Street Journal, and on the Brewers Association website. Several explanations have been offered for the challenges can manufacturers have faced in producing enough cans to meet demand: the difficulties in keeping up with surging hard seltzer volumes, which are virtually 100% canned; the way canned offerings are devouring market share in the craft beer world; and, more recently, changes in beer drinkers’ behavior due to the pandemic-related lockdown (of course, similar shifts for soft drinks created even greater pressure on can production capacity).

We decided to investigate which, if any of these, is the most significant in terms of creating the bottleneck (no pun intended). Of course, each has played a role, but could one be singled out as the real culprit? After crunching some numbers – which admittedly rely on many assumptions and rough estimates – we’ve discovered a wild card in the mix. Not surprisingly, hard seltzer growth appears to be the biggest contributor. But there’s also unexpected driver of additional shortfalls in can supply versus demand: canned mainstream beer (defining “mainstream” as domestic non-craft, plus imports). And, as we’ll see, this has implications for avoiding potential can shortages in the future.

Several pieces of context must be kept in mind when analyzing this. First, the rapid growth of cans in any of these areas isn’t the problem per se; shortages are tied to unanticipated growth, over and above prior expectations. Second, it can take up to 18 months for can manufacturing capacity to be added, so unanticipated growth can be seen as the difference between actual can volumes and the figures that would have been projected 1-2 years earlier. Third, while the word “shortage” wasn’t used often in 2019, can inventories had already been seeing reductions in response to unanticipated demand. And so, in order to sort out the effects of the pandemic from other factors, we’ll begin by examining what was going on in 2019.

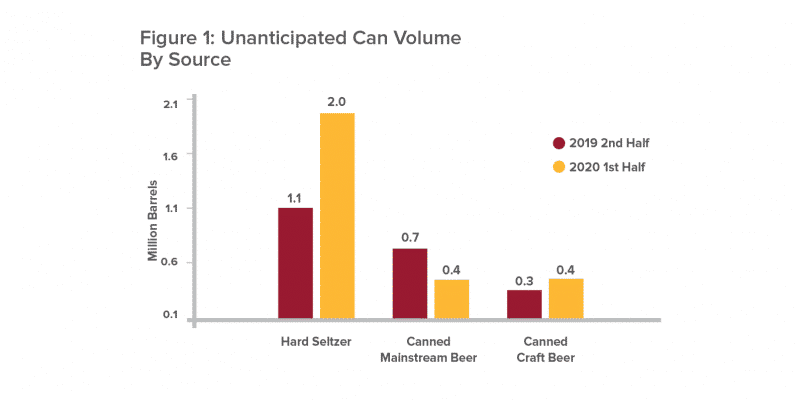

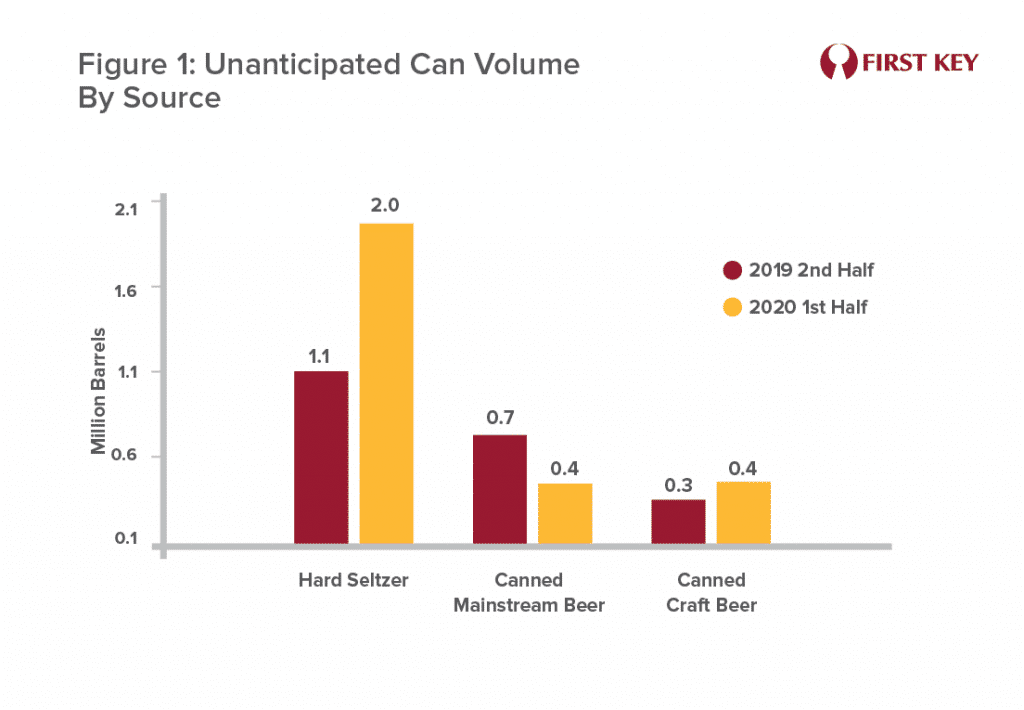

But while the explosive growth of hard seltzer and craft beer in cans had been capturing our attention in 2019, seemingly small changes in trends for mainstream beer can still have big impacts. Craft beer saw cans’ share grow from 24% to 31% between 2018 and 2019 (though only a portion of that growth could be called unanticipated). But cans’ share of mainstream beer, which had been relatively flat at around 62% for several years, jumped to 64% in 2019. Even two percentage points on a base that large makes a big difference. This yields an estimate of 0.7 million barrels of unanticipated can demand in the second half of 2019, a sizable secondary contributor compared to the 1.1 million barrels of estimated contribution by hard seltzer (See Figure 1).

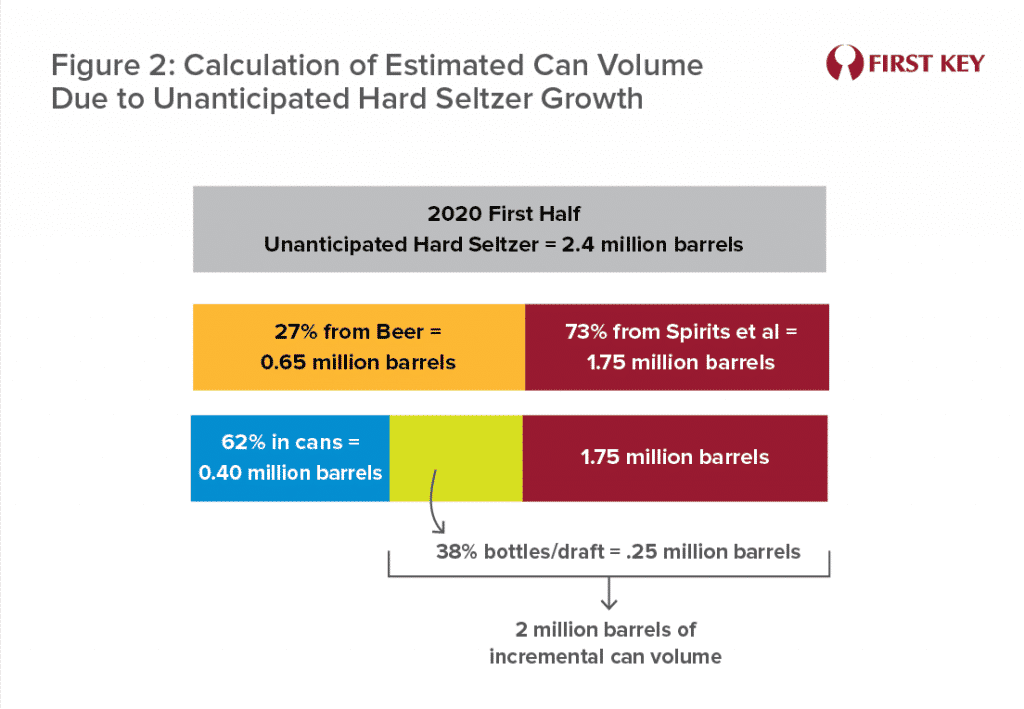

In 2020, of course, the entire dynamic changed. Hard seltzer surged more than ever, and we estimate it contributed a net 2 million barrels of unanticipated can volume in the first half. See Figure 2 for the calculation; the same math was used to develop the 2019 second half estimate.

We all know what happened in beer in 2020: despite declines in category volume, cans’ share of that volume surged with the shift to off-premise consumption. But while the interacting forces were different for mainstream and craft, the net impact was around 0.4 million barrels of unanticipated can volume for each. Cannibalization by hard seltzer offset much of the long-term and short-term growth in demand for mainstream beer in cans. On the other hand, craft beer saw more serious overall volume declines, estimated at 10% by the BA. The large majority of this was attributable to the pandemic response, as craft beer sales likely experienced relatively little cannibalization by hard seltzer (Figure 1).

But the net impact on cans’ share of craft beer conceals some dynamics. That share was 31% in 2019 (based on IRI and Brewers Association data). In the pandemic year of 2020, that share rose to an estimated 40.5% in the first half, according to BA economist Bart Watson. But that increase in cans’ share has essentially three components: (1) the dramatic drop-off in overall craft beer sales – a huge drag on canned craft volume, (2) the short-term surge in cans’ share as volume shifted in dramatic fashion to the off-premise, and (3) the long-term growth in consumer preference for craft beer in cans, which was still alive and well and making its presence felt, over and above-the short-term surge.

The first two of these will eventually recede when the worst of the pandemic and the lockdown fade to the past, but the last one will remain.

So, what’s the bottom line? It’s probably safe to say that hard seltzer growth is unlikely to catch anyone by surprise in coming years. But the pandemic may have concealed just how much consumer demand for canned beer, not only in craft but in mainstream, is still growing. And if the industry also wants to put the can shortage behind it, when it comes to capacity planning for cans those trends have to be part of the equation.

In craft’s case that growth has accelerated for each of the last four years – now that cans’ share of packaged beer is over 50%, it’s not quite mathematically impossible for the acceleration to continue, but it’s unlikely. Still, cans could easily reach 60% of packaged craft beer in the coming years. And if cans become that dominant in craft beer, there’s no reason to believe that mainstream beer – whose drinkers have long been more open to the package – won’t see a continuation of its own further shift toward cans.