Are beer drinkers and cannabis users the same consumer? They may have less in common than most people assume.

This is, in many ways, a very different question than the ones the beer industry has been asking recently. The prevailing concerns in the beer industry tend to relate to people who consume both marijuana and beer. For example, the headline on the Brewers Association’s recent presentation of a study by Headset, Inc., may have captured the big question on everyone’s mind: “Cannabis and Beer – Friend or Foe? Complementary or substitutable?”[i]

Yet in one of our earlier Insights pieces we estimated that, in a scenario where recreational marijuana is legal nationally across the US, there would be roughly 27 million beer drinkers who don’t use cannabis and 29 million cannabis users who don’t drink beer (we also estimated that 33 million will use both).[ii] The size of those numbers seems to indicate there is also value in understanding what it is that influences people to self-sort into one camp or the other—cannabis consumers or beer drinkers.

One approach that has been taken by more than a few researchers uses survey data to identify personality traits that are more commonly reported among cannabis users or among beer drinkers than among the general population. The results have been somewhat mixed.[iii] We decided to take a different approach by investigating whether personality data can explain variation in the real-world geographic performance of both beer and cannabis. The short answer to our opening question: yes, it appears that geographic variation in the prevalence of certain personality types does play at least a limited role in the geographic variation of interest in beer and marijuana.

Psychologists make use of a framework that may be familiar to readers, the Big Five personality dimensions. These traits are Openness to experience, Conscientiousness, Extraversion, Agreeableness, and Neuroticism. In 2009, a group led by University of Cambridge psychologist Peter Rentfrow published rankings for all fifty states for each of the five dimensions.[iv] This means you can now find out where your state ranks among the most Conscientious, or how one state compares to another in terms of Agreeableness.

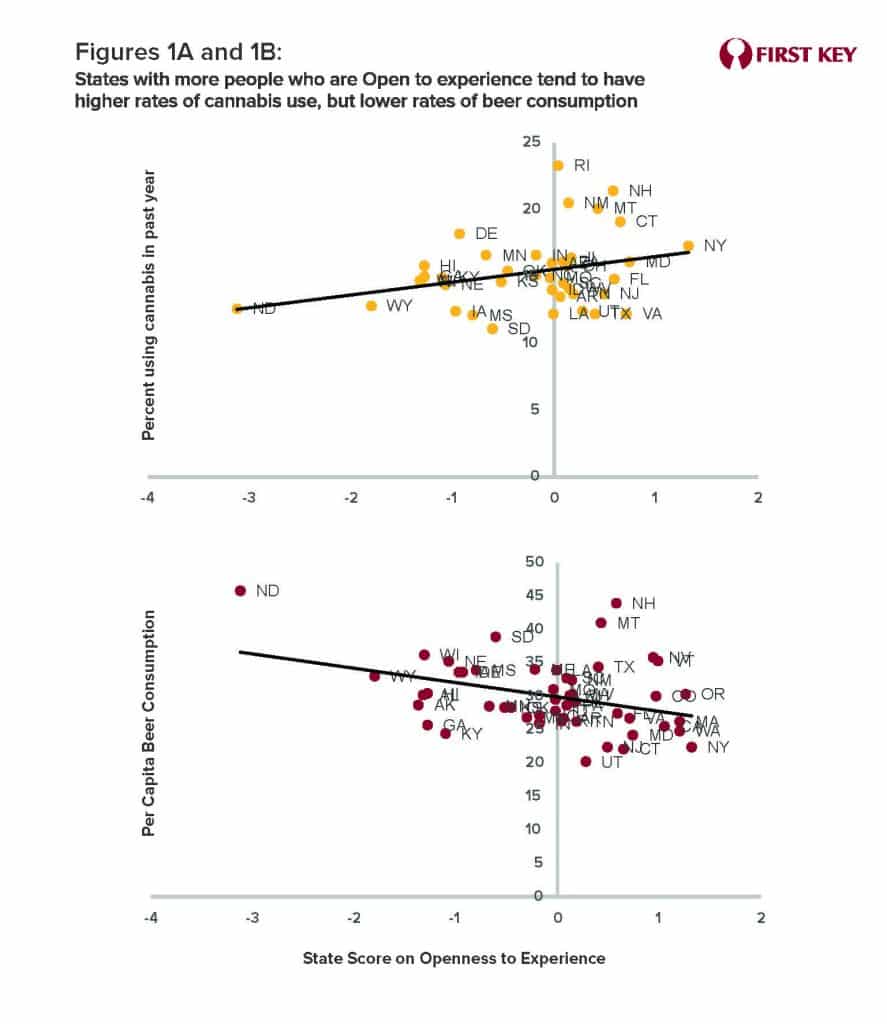

Figures 1A and 1B shows the relationships between Openness to experience, and the respective sizes of the beer- and cannabis-using populations,[v] Openness to experience is typically dimensionalized as inventiveness and curiosity, and so it’s probably not surprising that greater Openness in a given state seems to predict a larger base of cannabis users.[vi] What may be surprising is that Openness is negatively correlated with per capita beer consumption. But then, lower Openness is often framed as a preference for consistency, and that is part of what the biggest beer brands offer (craft beer and its variety-seeking enthusiasts notwithstanding). The fit is far from perfect in both cases, as there are clearly many other factors influencing cannabis use, but both correlations are statistically significant with a high degree of confidence.

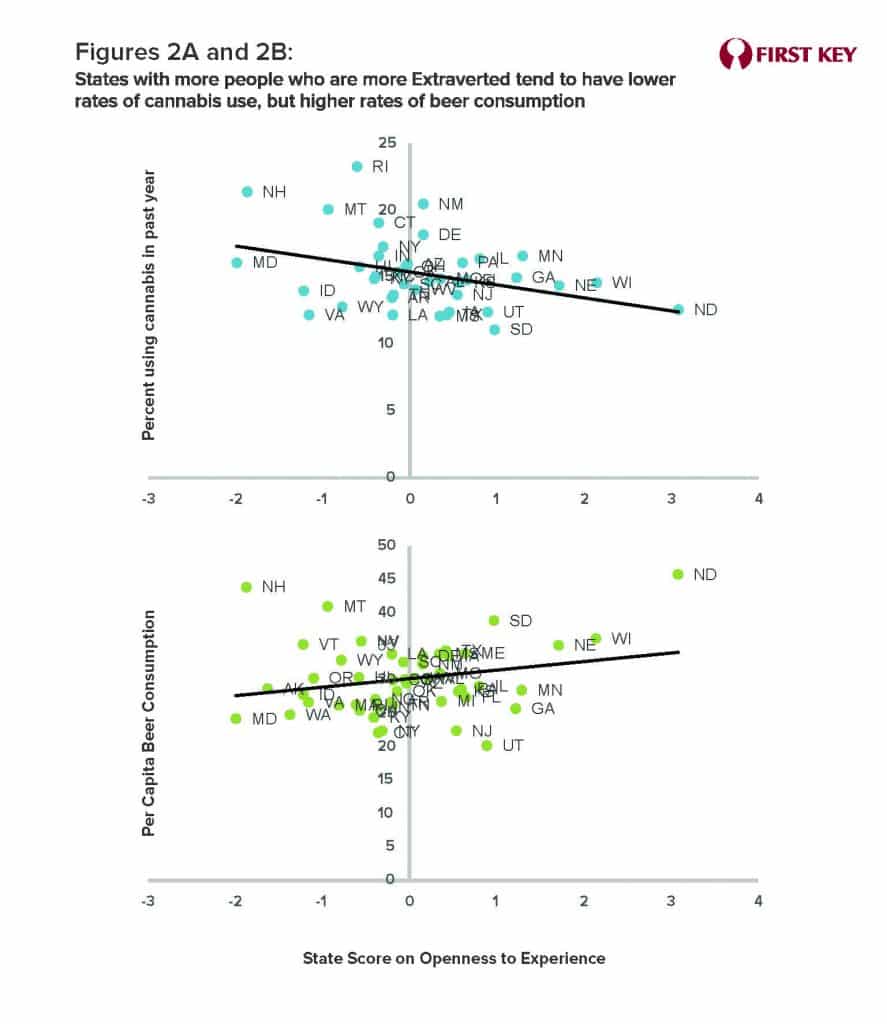

Figures 2A and 2B look at the relationship between another of the Big Five, Extraversion, and the relative development of both products. These relationships, are both statistically significant. Beer has experienced better development where the population is more extraverted (i.e., more outgoing and energetic), while cannabis seems to be stronger in states where people are less extroverted. Beer’s state-by-state development as a category is highly related to the relative density of bars,[vii] and bars are places where extraverted people thrive. With most marijuana use confined to the home even in states where it’s legal, this would arguably provide a better experience for those who aren’t as drawn to the crowds and noise level at bars.

While these correlations may be indicative of meaningful differences, the degree of difference should not be overstated. It is important that we not paint a picture of beer drinkers in boisterous crowds rejecting all new things while their cannabis-using peers are huddled at home seeking a steady stream of new experiences. But successful brands often help people tap into a side of themselves that’s underdeveloped or hidden in everyday life, and targeting consumers based on factors like Openness and Extraversion could be the starting point in future portfolio and positioning strategies.

When the U.S. legalizes marijuana nationally – as it inevitably will – brewers who have added, or are interested in adding, legal cannabis to their product lines won’t only be doing so as a defensive strategy designed to keep current consumers in the fold. Those brewers may well be adding new consumers from a pool of 29 million with very different wants and needs from current beer drinkers. In a portfolio sense, beer and cannabis will be highly complementary.

By Mike Kallenberger

[i] https://www.brewersassociation.org/events/cannabis-and-beer-friend-or-foe-complimentary-or-substitutable/

[ii] https://firstkey.com/cannabis-infused-beer-a-big-opportunity/#_ftn1

[iii] See, for example, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3036782/ or https://www.cambridge.org/core/journals/journal-of-wine-economics/article/abs/personality-traits-and-consumption-of-wine-and-beer/8239E521F36878D8975F942D799D38CB

[iv] http://www.readthehook.com/files/old/blog/wp-content/uploads/2009/04/rentfrow-geography-of-personality.pdf

[v] The two measures are framed differently, because of the type of data that’s available. Beer is measured as state per capita consumption http://beerinfo.com/beer-consumption-by-state-per-capita/, while cannabis is measured as percent of the state adult population that has used cannabis in the past year https://www.statista.com/statistics/723822/cannabis-use-within-one-year-us-adults/

[vi] We excluded those states where recreational marijuana use is legal, since these generally have much higher levels of cannabis use