A casual reader of headlines could be forgiven for coming to the conclusion that the alcoholic beverage market is drying up (pun probably intended).

Headlines on sites ranging from Forbes to Buzzworthy to the BBC tell us about the emergence of Generation Sober, early 20-somethings who are making it cool to shun alcohol. Prominent breweries from Anheuser-Busch InBev to Dogfish Head are taking the trend toward moderation seriously, betting their future portfolios on low and no-alcohol beers. And it seems everyone is wondering whether the alcoholic beverage category can continue to grow as alternatives like legal cannabis and even kombucha seem to be taking share of occasions.

The trend is clearly real, but will it have an impact as significant as the early responses seem to indicate? In fact, it’s hard to see any current impact in per capita consumption data for beer, wine, and spirits (as we’ll discuss later). But how worried should breweries be about this trend?

How different are today’s 21-24 year olds anyway?

It’s important to note that today’s 21 and 22 year olds aren’t in fact Millennials, but the leading edge of the next generation, the Centennials (often referred to as “Gen Z”). And those who study generational differences will tell you that the transitions between generations can be sharper than most people would expect.

Kantar Futures, a firm that studies American attitudes, offers a startling statistic from the company’s annual Yankelovich MONITOR survey. In 2000, 50% of then 12-19 year old Millennials agreed with the statement “We’re about fun.” In 2016, the same question was asked of 12-19 year old Centennials and only 17% agreed “We’re about fun.”

Centennials are a more pragmatic, responsible generation for reasons that should be apparent in hindsight: their worldview was shaped by cataclysmic events like the Great Recession and the seeming omnipresence of school shootings and lockdown drills.

Teenage Centennials are using both alcohol and marijuana at lower rates than did previous generations. The U.S. government’s Substance Abuse and Mental Health Services Administration reports that, after showing only modest declines from 2002 to 2009, alcohol use among 12-17 year olds dropped off from 27.2% in ’09 to 19.7% in 2017. Similarly, past-month marijuana use in this age range declined from just over 8% to 6.5% (even as use was increasing significantly among every older age group).

And as young adults, Centennials seem to be sticking with this behavior. Research firm Mintel reported last year that one in five 22-24 year olds had not had any alcoholic beverages in the past three months. This compared to 13% of 25-34 year olds. This flies in the face of what had been a truism for generations: those on the youngest end of the legal drinking age spectrum had always been the most likely to imbibe.

These are the sorts of trends that have more than a few brewers preparing for a very different future in terms of the alcohol profile of their portfolios.

In the face of softening sales for beer, including the once-thriving craft segment, the success of Michelob Ultra and its low calorie, low carb proposition has stood out. It may well be the inspiration for a lot of the plans being made by portfolio strategists at various breweries.

Anheuser-Busch InBev announced plans to grow the company’s low/no-alcohol beer portfolio to 20% of their global sales by 2025 (according to Business Insider).

Heineken has launched Heineken 0.0 in the U.S. Originally developed for European markets, the company now sees the potential for the alcohol-free brand to open up new occasions and new consumers to their products around the world.

Craft brewers, once known almost entirely for putting more into their beer, in recent years have been bringing out more drinkable styles that are somewhat lower in calories and alcohol. But some big names are now pushing even farther in that direction. Sierra Nevada purchased Sufferfest, a small but growing brewery specializing in “better for you” beers. And Dogfish Head, who brews some of America’s most extreme beers, is going all in on health-conscious offerings to capitalize on what owner Sam Calagione calls a “…younger demographic [who] is drinking less alcohol and when they are drinking alcohol they are thinking about it through the lens of health and wellness.”

For all that this newly emerging trend appears to have staying power, especially as more Centennials turn 21, the impact really hasn’t manifested itself just yet. True, beer consumption has been declining for a decade or more, but this has been offset by growth in wine and spirits, not any demonstrable aversion to alcohol.

Similarly, observers have pointed to the growth of legalized cannabis and even drinks like kombucha as threats to the future growth of beer and other alcoholic beverages. Forbes reports that legal cannabis is now an $8.5 billion industry, while Reuters reports annual sales of just under one billion dollars for kombucha. Given that the U.S. beer market now generates $111 billion in sales, in theory cannabis and even kombucha should be big enough to take a measurable bite out of alcoholic beverage sales. But the evidence on whether or not that’s actually happening is still mixed.

From a macro view, adult per capita consumption of alcoholic drinks has not shown any significant changes in recent years. In fact, in the long run the only factor that has driven changing trends in drinks consumption is the share of the adult population in the 21-24 age range. The higher the number of 21-24s per capita, the higher the consumption of alcohol per capita.

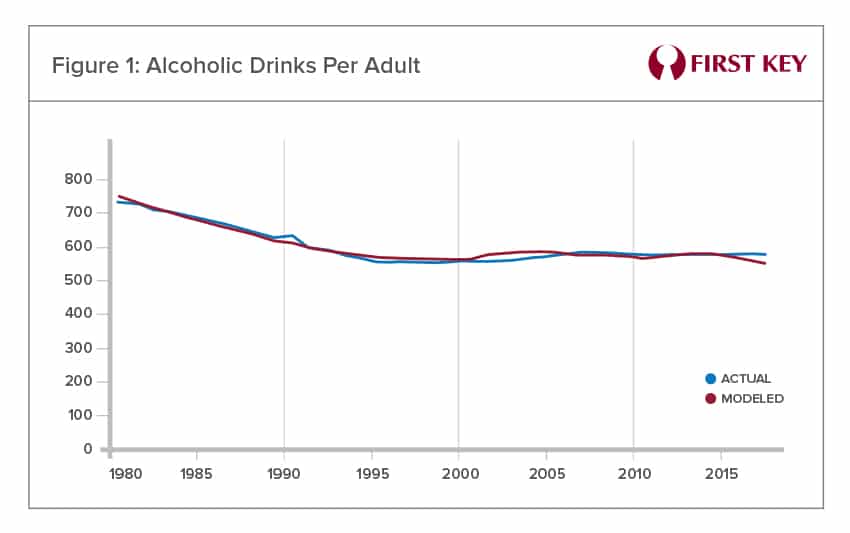

Figure 1 displays two lines. The first represents drinks consumed per adult from 1980 to 2017, using the traditional definitions of a drink as 12 ounces of beer, 5 ounces of wine, or 1.5 ounces of spirits. The second line shows an estimate of drinks per adult based on a simple regression model with only one causal variable, the proportion the adult population that’s 21-24 years old.

The fit is extremely close. If in fact today’s 21-24 year olds were drinking less than their counterparts had in previous generations, we would expect to see these lines diverging in recent years. And in fact they are diverging in 2015-2017 – but not in the direction that would indicate an alcohol-avoiding generation is coming onto the scene. Per-adult drinks consumption is actually higher than the model predicts – it remains essentially flat even as the percent of 21-24 year olds in the population has actually declined slightly.

The bottom line is that it’s still too early to know just how significant this trend “away from alcohol” will be. While it’s unlikely the trend will simply fizzle out, it’s difficult to confidently state that it has staying power. What may emerge is not a marketplace with fewer people drinking alcohol, but rather more people drinking beer because low and no alcohol brands have kept reluctant alcohol drinkers in the market.