Across the world, there has been a transformation in how manufacturers sell their products in retail, and the brewing industry is no exception. In fact, the beer industry has seen more disintermediation than others, with the craft brewing sector making a mark not only how consumers buy product at retail, but also in how consumers consume, including brand preferences and volume. The entire beer supply chain has been under change, not only due to this influence of the craft brewing sector, but also due to an impact from e-Commerce and Omnichannel retail marketing, and of course, that of the COVID-19 pandemic. With so much in flux at the present, beer manufacturers, distributors and retailers may not have their eye on the future, but they must begin to think about the future of post-COVID markets, of which one thing is for sure: manufacturing, distribution, retail, and consumption will change dramatically from the present.

The brewing industry is well aware of what’s happening in Craft, and of course, everyone is immersed in the impact of COVID, but a concept of Omnichannel Marketing or Retail is less understood, even though we understand it well as consumers through our purchases from Amazon and other marketplaces. In most nations, the beer industry is more structured than other consumer staples, so beer manufacturers and distributors have stayed in their lanes not having to innovate so much to maintain or grow market share. Believing that this is a viable longer-term strategy is a mistake as the COVID-19 pandemic loosened some of these market restrictions and our industries key target market demographics of the beer industry being younger (21-25) and more tech savvy. Therefore, while Omnichannel retail has been less important to the beer industry than others, the writing is literally on the wall for what is about to happen in our industry given our customer demographics, technology and the changing nature of the alcohol supply chain and its growing competitiveness including wine, spirits, and even cannabis. The next decade might be the most disruptive in the history of our industry since the Prohibition as so many market forces and imperatives conflate with other dynamics, such as e-Commerce, social/cultural norms due to the pandemic, and other forces.

So exactly, what is Omnichannel? Omni-channel retail is a multichannel approach to sales and marketing that focuses on a seamless experience in ordering and fulfillment for the consumer through an integrated supply chain management system. That means that a consumer can order from their mobile device, computer, in person or numerous other ways, and can have the product delivered to their doorstep, put in a drop box, picked up at the store, or other virtual/physical options. Omnichannel retail or marketing is a proliferation of offering the consumer to buy and receive in many different experiences and possibilities as a means in increasing sales.

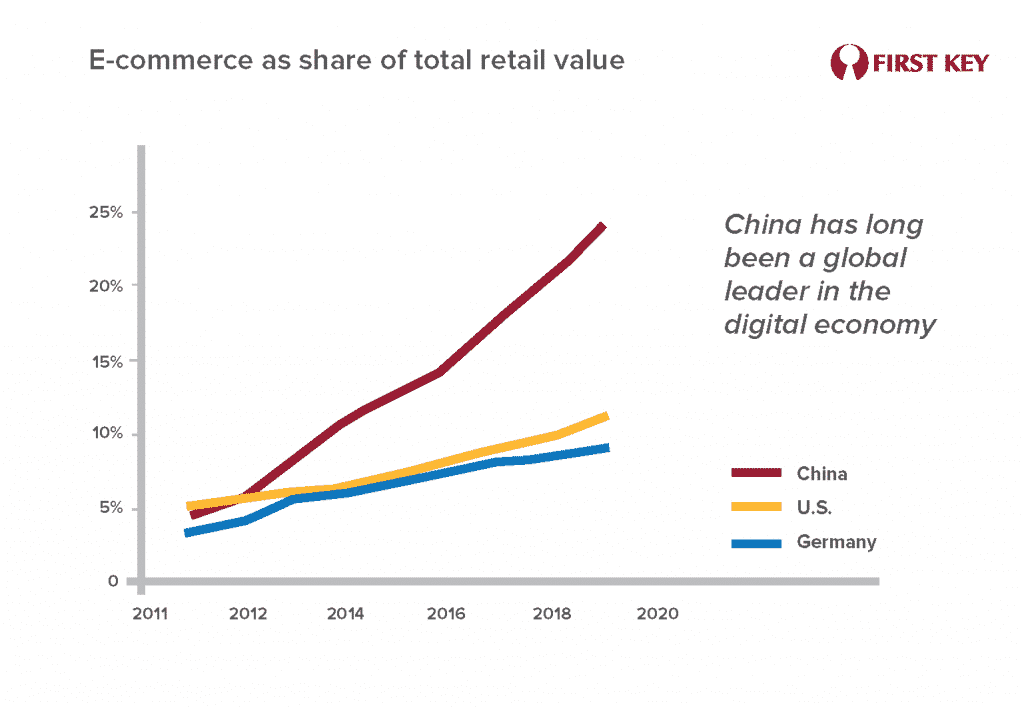

In much of the Western world, these shopping and fulfillment experiences are exemplified by large retailers such as Amazon, Walmart and Tesco, but you may be surprised to learn is that China and the East are the innovation leaders in this new model of marketing and supply chain. As is shown in the graph below, China has been the worldwide leader in e-Commerce and Omnichannel for nearly a decade, driven by a ubiquitous use of the personal smartphone for many aspects of a consumer’s life, including social media, mobile commerce, mobile payments, and cross-border commerce. Not only is the Chinese consumer purchasing more than half of their expenditures online, they are making payments through their smartphone as well, with over 80% of its population doing so versus only 30% in the U.S[i]. Not only is China the world’s leader in e-Commerce and Omnichannel sales and marketing in retail, it seems to be the innovation driver as well. From what we have learned from China, not only are today’s consumer more willing to purchase their products online, but they are also becoming increasingly comfortable in doing so, especially given restrictions imposed on retail and social distancing due to COVID-19. What has emerged from the post COVID-19 model is not just an acceptance of buying online, but more so in the consumer wishing to have as many options as possible in both buying and receiving products.

The global beer industry is over a half a trillion-dollar industry, with a consistent growth rate of 3-4% compounded annual growth rate (CAGR) over years and expected to continue in the near future[ii]. While the industry is growing, so is the variety/complexity of product/brands as is the competition from other industries. As such, not only will the industry need to become more agile in its manufacturing capabilities, it will need to do so from a distribution and retailing standpoint, especially as e-Commerce challenges the rules of existing distribution across markets. In the U.S., the e-Commerce revolution for the beer, wine and spirits industry is beginning, with the largest marketplace, Drizly having grown 350% from 2019 to 2020, and expecting the entire e-Commerce market for alcohol to grow from 2% in 2020 to 20% in five years[iii]. This e-Commerce marketplace is growing significantly in the U.S. and a few places in Canada, in 235 markets through a vast distribution network connecting through over 3,000 retail partners, but it is essentially an extension of the U.S. three tier distribution model to add a fourth tier rather than disintermediating the existing system to be direct from manufacturers or distributors. And yet, while China has surpassed the world regarding total e-Commerce sales for over a decade, it is the U.S. market that is the largest in the world for alcohol, with its market surpassing China in 2020 due to a loosening of direct shipping laws given the COVID-19 pandemic[iv]. There is no question that the alcohol retail market is moving in this Omnichannel direction across the world in the future, the question will be how will it happen and will the existing supply chain stakeholders of manufacturers, distributors and retailers be prepared, or replaced with innovative market start-ups able to disrupt the current environment. As such, we should expect that the future of commerce in the beer business will not be an extension of the existing distribution channel of manufacturing to distribution to retail, but rather a replacement of it altogether.

To be ready for the future, or even the present, beer manufacturers, distributors and retailers must develop an Omnichannel retail strategy to extend their present state model. Not only this, but these companies must ensure that these new supply chains coincide with their supply chain partners, or they must be willing to disrupt their existing relationships in favor of a new strategy. Or both. But what existing beer industry companies must not do is to ignore the writing on the wall that is so clearly evident in the data. It is becoming increasingly important for a company to think more about how a consumer purchases a product than the product itself that is a paradigm shift in a way of thinking of our consumer product, marketing and supply chain strategies. According to AC Nielson, today’s consumers purchase nearly half of their beer from convenience stores, 45%, versus 35% that purchase the product at a grocery store. With 80% of convenience stores also having gas stations, what will happen to the buying dynamic in the future when cars are electric and nearly all of the power generation is happening at home versus away? This is just one of the many potential disruptive scenarios in the retail markets of tomorrow aside from the growing consumer use of the smartphone for everything in their lives. In China, it is called “social commerce”, and similar trends are heading to other nations around the world as well.

A future manufacturing/distribution/retail strategy for stakeholders in the beer business will take time to manifest, but once it happens, it will lead to a complete disruption for all parties involved. We only need to look at what’s happening today in other industries to see the effect on those stakeholders who were not able to adapt during the COVID-19 pandemic. In other industries it was the companies who were prepared for Omnichannel were very successful during the pandemic and gained market share from those who weren’t. The same will hold true in the beer industry regardless of whether the company is a beer manufacturer, distributor or retailer in any country around the world. When this will happen is unclear, but what is for sure is that it will happen, and likely sooner than we think.

By Dr. Jack Buffington, Director of Supply Chain and Sustainability

[i] Statista, 2021. “Smartphones in the U.S. – Statistics and Facts”.

[ii]Businesswire, 2021. “2021 Global Beer Market and the Impact of COVID-19: Market Volume, Value and Dynamics for Past Five Years”. April 22.

[iii] Prokop, Hannah, (2020). “Drizly Reports 350% Increase in Sales.” Cspdailynews.com. December 17. Found at: https://www.cspdailynews.com/beverages/drizly-reports-350-increase-sales

[iv] Carruthers, Nicola. (2020). “US forecast to become biggest online alcohol market.” November 30. Found at: https://www.thespiritsbusiness.com/2020/11/us-forecast-to-overtake-china-as-biggest-online-alcohol-market/