Despite the growth of craft breweries over the past 15 years, the global beer market worldwide is largely defined by its consolidation; according to a Business Wire article, the 2021 global beer industry is valued at nearly a half a trillion dollars, with the four largest brewers equal to approximately a quarter of the total volume[i]. This trend toward industry consolidation is not isolated to beer, as is evident at the supermarket, with only ten large food companies being responsible for a large majority of the 100,000 SKUs in a supermarket, despite the perception that these separate brands are manufactured and distributed by different companies[ii]. Retailers have grown, not through an assortment of product variety through a myriad of suppliers, but rather through supply chain efficiency via large manufacturers with a wide portfolio of their own product offerings. This has led to a synergistic supply chain relationship between large manufacturers and retailers to distribute products at the highest quality, the lowest cost, and the most efficient information system transactions. In supply chain, we call this a frictionless supply chain, growth through improvements in how products are forecasted, ordered, and distributed. While a limited number of craft brewers can beat the odds through getting their products on the shelves of the largest retailers through their distributors, the distributor can only make so many small bets on craft beer, with a larger mindset focused toward safer, higher volumed transactions of larger brands with its retail partners. For example, Walmart has over 4,600 grocery stores in the U.S. out of the almost 40,000 in total, and it commands 26% of the total grocery volume. Craft breweries have a difficult time winning in these consolidated supply chain and retail systems.

What, if anything, can craft brewers do about this? Since 2005, the craft beer industry has grown significantly, over 300%. But more recently that growth has stalled, and even fallen, with a 9% decline from 2019 to 2020, and a market share drop from 13.6% to 12.3%[iii]. And yet, despite the limited growth in the present and possibly into the future, there are 9,000 craft breweries, a lot of providers within a shrinking market. This topic of “what to do about craft?” has been one of great concern in the sector, with most opinions focused on restoring Craft originality and authenticity. This seems like a logical response, and yet, at the same time, it is nearly a mathematical impossibility to achieve a restoration of Craft’s roots when there are now 9,000 breweries rather than just a few hundred or so. This sense of originality and authenticity is leading to an expansion of product offerings beyond Hazy IPAs and Chocolate Porters to Double Barrel Aged Sour Ales or Imperial Stouts because the industry grumbles that its millenial consumer “won’t drink the same beer twice”. Predictably, while most craft brewers see themselves as going after the 87-88% of the market commanded by the big brewers, unless they adjust to the new world of fricitonless supply chains they may find themselves fighting amongst themselves for the much smaller share of the pie currently attributed to Craft. The moral of the story is this: craft brewers need to develop strategies to focus on transactional efficiencies, or a so-called frictionless supply chain as a way to competitively grow market share, as much, if not more than creating the next unique beer offering. I know that this sort of statement is a form of heresy to many in the craft sector, but the numbers don’t lie: the market, enabled by the present state supply chain system, may have hit Peak Craft in the year 2020.

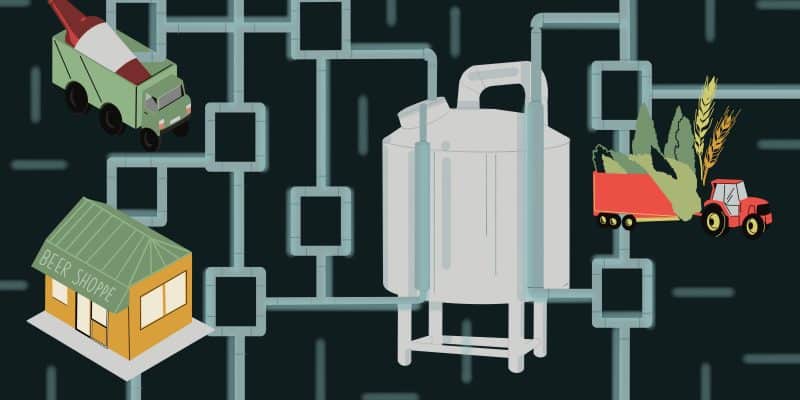

Before concluding that the craft beer sector is relegated to being a niche player in the U.S. beer market due to these challenges, think again: what if there is an emerging solution that could level this transactional playing field, enabling the 9,000 craft breweries to compete with the largest manufacturers in the world? There is such a solution on the horizon called blockchain, a decentralized centralized ledger system to enable companies to transact across their supply chains more fluidly. A solution that has become popular relating to cryptocurrency, such as its use as a payment method that the Threes Brewing in Brooklyn, has launched, or Downstream Beer, based in Ireland, that offers the self-proclaimed, “world’s first blockchain beer” through full traceability of its brewing methods. Both of these applications in blockchain technology as first-generation technologies will be useful in the craft brewing industry, but likely not sufficient to gain market share over the larger brewers. Instead, blockchain needs to be applied to create a transactional supply chain system rivaling the traditional supply chains of today, from planning to sourcing to production to distribution and retailing. It is to achieve a 21st century frictionless supply chain that can compete against the big players.

Think about how a decentralized beer supply chain driven by these crytoplatforms could be a gamechanger in the beer business, leveling the playing field where craft competes with big brewers. On the front end of the brewing process, a blockchain platform could enable smaller craft breweries to procure raw materials and transportation services through creating virtual economies of scale through pooling arrangements through local or even regional craft breweries. Through a centralized-decentralized transactional ledger system, barley growers could transact directly with these craft brewers, as easily as the larger farmers do today with Anheuser Busch InBev and MolsonCoors, in a similar efficient, cost-effective manner. A blockchain transactional system of centralized-decentralized could make it as seamless for a barley farmer to procure with a large brewer as it would 50-100 craft breweries. Likewise, the retail environment could fragment as well in an efficient manner that would allow smaller craft breweries to be competitive in selling in smaller retail outlets versus today’s dominance of large brands at large retailers. This would be accomplished through a centralized-decentralized ledger transactional system that allows decentralized supply chains to operate in a similar manner as these larger relationships have as their advantage.

In comparison to others, the beer business is behind the curve in the use of blockchain technology as an industry solution; in comparison, the transportation sector has had an industry consortium focused on the development of blockchain for a few years now (Blockchain in Transport Alliance, or BiTA), and even a well-known executive from a top company as its leader (Dale Chrystie from FEDEX). There is a strategy, not only to develop and implement process and technology standards, but to collaborate across competitors (e.g, UPS and FEDEX) for the betterment of the supply chain. In contrast, the beer industry has no BiTA nor Dale Chrystie to drive change, leaving any initiative taken on by a company to be proprietary and siloed. Imagine the possibilities of a centralized/decentralized ledger-transactional system for the beer industry that would provide transactional economies of scale for the craft breweries given their current state! Given the stagnant forecasts of this segment over the next decade or so, this could become the most important initiative in its history!

Can blockchain save the craft beer industry in the 2020s? The answer to this question depends on the craft community’s understanding of the problem that it currently faces: if it continues to believe that the answer is in Craft’s roots from the 2000s, it will continue to head in the wrong direction. In contrast, if it believes that it already makes great products, and needs to become more proficient from a supply chain and retail standpoint, this could become a rallying point toward reinforcing the collaboration that the craft community has long prided itself on, rather than finding themselves forced to compete over a limited market share amongst 9,000 breweries. The technology around blockchain is relatively simple, and easy to outsource to technology professionals. In contrast, the industries that are truly leading in this space, such as the U.S. transportation sector, understand that it is the development of new processes and business relationships that can drive change, but is more difficult to achieve from a strategic standpoint. Leaders within the craft brewing industry must establish a new direction that doesn’t compromise the quality, originality, and authenticity of its beer, but enables its distribution from transactional improvements in the supply chain from sourcing to production to distribution. If Craft can envision this as a vision, it will crack the code of how it will grow in the 21st century.

By Dr. Jack Buffington, Director of Supply Chain and Sustainability

[i] Businesswire, 2021. “2021 Global Beer Market and the Impact of COVID-19: Market Volume, Value and Dynamics for Past Five Years”. April 22. Found at: https://www.businesswire.com/news/home/20210422005588/en/2021-Global-Beer-Market-and-the-Impact-of-COVID-19-Market-Volume-Value-and-Dynamics-for-Past-Five-Years—ResearchAndMarkets.com.

[ii] Mattison, Lindsay (2021). “10 of the Biggest Food Companies Basically Own Every Grocery Item You Buy.” Open Wide Eats. July 6. Found at: https://www.wideopeneats.com/biggest-food-companies/.

[iii] Morris, Chris (2021). “Despite Zoom happy hours and day drinking, 2020 wasn’t a great year for craft brewers”. Fortune. April 6. Found at: https://fortune.com/2021/04/06/craft-brewers-2020-sales-market-share-closings-beer-independent-brewers-association/