The brewing industry is experiencing a packaging revolution, with innovations and trends influenced by the rise of craft beer, changing drinking habits, and concerns for the environment. The global pandemic, which emerged just over two years ago, accelerated some of these trends, particularly by magnifying the demand for aluminium cans while pubs and bars were closed, and drinking at home was the only available option. Alongside the growth of small formats, the pandemic has also reinforced consumer environmental concerns, fuelling debates over which conventional packaging offers the greenest solution and driving sustainable packaging innovation.

The year of the can

“Last year there was a lot more demand for analysis on cans,” says Ingo Pankoke, head of Research Institute for Management and Beverage Logistics and of Beverage Packaging at Berlin’s VLB. Pankoke highlights how the demand was closely related to the shutdown of pubs and bars across the globe, with breweries forced to package their entire production in small formats as home consumption increased.

Indeed, research data show that the market for cans, already flourishing pre-pandemic, is projected to grow further over the coming years. According to Future Market Insights (FMI), the global drinks cans market is projected to reach US$ 107.8 Bn by 2031, with the US estimated to hold the largest revenue share in North America at nearly 72.5%, and China and India at 42%, and East Asia at 31% of sales.

Growing demand and rising pressure due to the shortage of cans has led manufacturers to increase production around the world. For example, Ball Corporation has announced new aluminum can facilities in the USA (Pennsylvania and Nevada) and in Europe (Pilsen, Czech Republic and the United Kingdom ).

“The demand for cans is still growing. Here in Germany it has increased after the introduction of the deposit scheme,” says Pankoke, who suggests that the growth of craft beer across the country — and in central Europe — is certainly driving the trend, with unusual formats such as 440ml (15oz) spiking demand. He highlights however, that overdemand is also causing some quality issues: “Perhaps can suppliers produced batches that were not so good in terms of quality, as we’ve seen many that [burst open].”

The CO2 challenge

In line with wider consumer trends, care for the environment continues to inform beer drinkers’ purchase decisions. The latest Global Consumer Trends report by market research firm Mintel shows that consumers are supporting brands that they feel can help them mitigate their impact on the environment, claiming that “companies that don’t proactively change ahead of the climate crisis will be forced to change because of it.”

Ethical shopping is indeed a key driver behind the growth of cans, with aluminium beverage packaging generally perceived as more environmentally friendly than glass. Metal cans made of aluminium are recyclable and their lighter weight can help curb a beer’s carbon footprint.

A recent report commissioned by Finnish alcohol monopoly Alko, claimed that 33cl (circa 11oz) aluminium cans can reduce a beverage’s CO2-per-litre emissions by 3.5 times when compared to a 75cl (25oz), 540g-heavy glass bottle.

The glass industry is responding to the challenge by reducing the weight of bottles while retaining tolerance to beer’s high pressure. “In terms of glass,” says Pankoke, “what we’ve seen is that there’s a general trend towards reducing the weight of bottles. We have a lot of breweries in Germany that have introduced new bottles, which look very similar to the old ones but are much lighter in weight.”

These include Warsteiner, Bitburger, and the Radeberger Gruppe, yet the race for lightweight glass is by no means limited to Germany. Last June, Anheuser-Busch InBev (AB InBev) unveiled a new, 150g lightweight beer bottle that they claim reduced carbon footprint of 17% compared to its standard 180g longneck bottle.

While any glass bottle is necessarily heavier than a can — and thus responsible for higher carbon emissions during transportation — secretary general at the European Container Glass Federation (Feve) Adeline Farrelly argues that, as manufacturers increasingly up their renewable energy game, glass beer bottles could soon be seen as more environmentally friendly. She adds that the comparison between glass and other types of packaging shouldn’t be limited to CO2 emissions: “You also have to account for the provenance of material and what happens to that material if it’s littered. If a glass bottle ends up in the water, eventually it turns into sand… We also use local raw material in our industry as most sand comes from within 300 km from the plants. Lastly, we don’t use critical raw materials, like aluminium. If that runs out, there’s a knock-on effect on all industries that use it.”

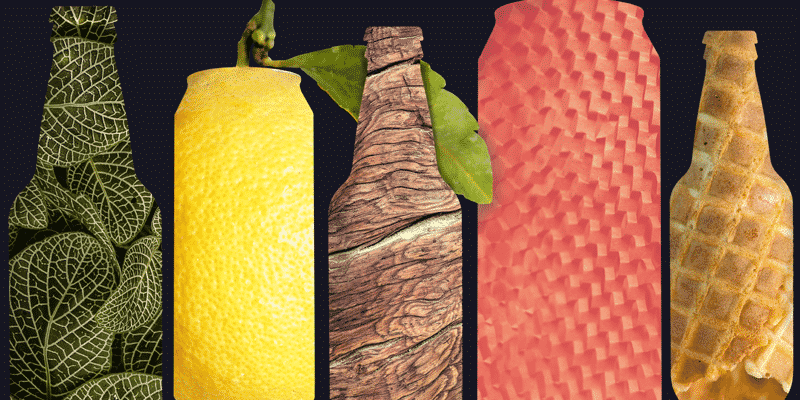

Neither glass nor aluminium

While aluminium and glass battle for the title of greenest conventional packaging, manufacturers look at breaking away from traditional materials altogether. As previously reported by First Key Consulting, Denmark-based Carlsberg is working on a fully bio-based and recyclable paper container, dubbed the Green Fibre Bottle, to be used on its flagship Danish Pilsner. “The biggest challenge is to find a barrier with the right properties to achieve this,” explains Pete Statham, sustainability manager at Carlsberg Marston’s Brewing Company & Carlsberg Group. “That means working with two world-first innovations simultaneously – the paper fibres that form the bottle, and a brand-new bio-based and recyclable barrier material. And I’m pleased to share that our new barrier is performing well.”

Carlsberg is part of a growing association of companies, including Pernod Ricard and Coca-Cola among others, which united under the common goal of innovating in the field of plant-based packaging. “In the last year we’ve welcomed [American multinational consumer goods corporation] Procter & Gamble to the Paper Bottle Community,” says Statham, “working together to pioneer the development of the paper bottle. And soon we plan to put the bottle in the hands of consumers for the first time.”

A look at secondary packaging

While alternative containers are certainly an area of key interest for breweries and manufacturers, innovation is coming in the form of secondary packaging, too. Germany-based Krones Group developed a range of plant-based secondary packaging including TopClip and GreenClip for standard beer cans and sleek cans, and a zero-plastic PaperPack module for 12- and 24- beer packs. Not only are these solutions plastic-free, fully renewable, recyclable, and biodegradable, both TopClip and PaperPack’s extra surface allows for additional branding opportunity and provide cover for can lids, thus preventing contamination.

Meanwhile, AB InBev looked at secondary packaging too. Last March, the company announced the roll out of a new, circular form of packaging for six-packs made from surplus barley straw combined with 100% recycled wood fibres. The new six-pack was three years in the making at AB InBev’s Global Innovation and Technology Centre (GITEC).

Riding the low-abv wave with draft innovation

Demand for small formats isn’t waning any time soon, yet the closure of on-trade venues didn’t hinder the development of cutting-edge larger formats. Diageo’s Guinness recently introduced MicroDraught, a compact system that recreates a draft beer experience with no need for bulky kegs and gas lines. Guinness’ release is the latest in a series of innovations that respond to the growing consumer and industry need of compact dispense systems, from Heineken’s Blade and The SUB (Krups), to ABI’s PerfectDraft (Philips).

Tapping into the trend yet combining it with environmental concerns and spiking demand for lower-abv beer, Colorado-based Sustainable Beverage Technologies created BrewVo, a brewing process that produces fully fermented, 6x dense beer (MBB), stripped of its carbonation and most of its alcohol content. The beer can then be “reconstructed” to the chosen abv either immediately before canning or bottling, or just before consumption at the point of sale by using the company’s patented NexDraft Tap System.

“You have the ability to reconstitute it straight away, adding water, alcohol, and CO2,” says Sustainable Beverage Technologies CEO, Gary Tickle. “You can add no alcohol and you have a beer with an abv of less than 0.5%. You can also add just part of the alcohol, making a session beer.” Tickle explains that BrewVo’s bag-in-box format can be frozen as soon as produced and defrosted just before use. It takes only one-sixth of the room needed for a keg and weighs much less too, which results in easier handling, lower carbon emissions, and helps maximise bar space. “You can take that MBB and redirect it to our bag-in-box, then ship it out to the customer and pour it on tap using our tap system that looks just like a normal tap tower. The kegerator also looks like a normal kegerator, but inside you have six different beers because each only takes ⅙ of the space.” says Tickle.

What’s ahead for packaging innovation

Over the coming months, the increasing appeal of aluminium cans, consumers’ environmental concerns, and the growing demand for no and low abv products are likely to keep characterising packaging innovation.

Alongside these trends however, new technologies are also going to be affected by the slow yet steady reopening of society, as the weakening of Covid-19’s latest variants contributes to consumer confidence leading to the partial recovery of the on trade sector.

By Dr. Jacopo Mazzeo