In 2018 there was a bit of fanfare, at least among those in the beer industry, when Keith and Jodi Villa announced their plans to launch Ceria Beverages. Keith, already highly lauded as the creator of Blue Moon Belgian White almost a quarter century earlier, would be turning his talents to creating alcohol-free beers infused with THC, which had been legal in the couple’s home state of Colorado since 2012.[i] It struck many in the industry as bold, smart, and timely.

But after only a little over two years in the market, and with far less fanfare, Ceria changed its product line-up, dropping THC as an ingredient in favor of brewing and selling more familiar alcohol-free beers. The Villas had found that, legality in Colorado notwithstanding, “…the federal illegality of cannabis made business very difficult. We decided to pull back and wait on the sidelines until federal legalization.”[ii] In addition, it turned out that dispensaries had some drawbacks when it came to selling refrigerated cannabis beverages.

For many in the beverage industry who may have faced similar obstacles, hemp-based THC beverages may have seemed like the answer. When hemp-derived THC became seemingly legal anywhere it was because it had been “legalized” in a legal gray area everywhere – at the federal level, thanks to its inclusion in the 2018 Farm Bill. And today the gold rush certainly seems to be on when it comes to cannabis beverages.

But the landscape may not be evolving in the way the industry had initially anticipated. In particular, in one very real sense the regulatory situation for hemp has flipped the marijuana storyline on its head: Marijuana has been legalizing at the state level while remaining illegal at the federal level, yet hemp has been essentially legalized at the federal level while almost continuously facing new restrictions at the state level.

In fact, there’s a dance between marijuana and hemp in terms of changing laws and shifting consumer demand. And how the two forms of cannabis ultimately decide their relationship may help determine where cannabis beverages fit in the overall beverage market.

For those who may not be aware, hemp and marijuana are different cultivars of the same plant, cannabis sativa L., with the only recognized difference being the respective content of THC, the psychoactive component historically associated with the “high.” If the plant contains more than 0.3% delta-9 THC on a dry weight basis, it’s classified as marijuana, which is federally illegal; less than 0.3% delta-9 THC, and it’s federally-legal hemp. When the 2018 U.S. Farm Bill was passed, it left out all isomers of THC, and seemingly created a legal gray area of delta-8 and delta-10 THC derived from hemp (unintentionally so, if some are to be believed, but that’s a different story). “These two THC isomers are present in very low quantities in the hemp plant, but can be readily formed by combining the richly occurring CBD cannabinoid with acid, heat or zeolite,” According to Keith Villa.

He went on to explain that another so-called loophole in the Farm Bill was exploited by some suppliers who insisted that the 0.3% delta-9 THC dry weight basis could potentially be applied to the weight of a finished product, rather than strictly the hemp plant. When applied to products, such as a beverage or gummies, the milligram amount of delta-9 THC could be dosed at very high and intoxicating amounts, yet still be below the legal 0.3% limit. Regardless of the legal loopholes and gray areas, THC in any form remains federally illegal according to the DEA and FDA. The DEA considers all THC as a Schedule 1 drug, with no medical value and a high risk of addiction. The FDA prohibits hemp-derived THC in foods and beverages sold in interstate commerce, but so far, has not prosecuted anyone unless they have made a health claim. Additionally, the TTB, per Circular 19-1, will not approve any formulations that include hemp ingredients, except for hemp seeds and hemp seed oil. The Farm Bill has been extended once, and may or may not be renewed in its current form again (but that’s also a different story).

While this has resulted in a surge of interest among manufacturers, retailers, and consumers, the category appears to be developing quite unevenly across states. The market for hemp beverages in a given state is in fact influenced more than a little by whether or not marijuana is legal in that state, and the influence of legal weed is arguably more negative than positive. That’s because hemp-derived THC and marijuana may in fact function to an extent as competitors.

First, from a consumer perspective, demand for hemp beverages appears to be lower in states where marijuana is legal. As an economist would say, hemp-derived THC beverages would appear to be an imperfect substitute for marijuana itself, and so demand for the former is strongest when the latter is less available. As prominent industry writer Kate Bernot pointed out in a piece for Sightlines last year, “Geography is critical” to such sales. “…almost 60% of hemp-derived THC beverage sales took place in the South, where medical and/or recreational cannabis is widely illegal. The Northeast, where a majority of states allow recreational cannabis…holds 16% share of hemp THC beverage sales.”[iii]

If legal marijuana really does limit the demand for hemp beverages, an entire country may be more evidence of that. Industry observers in Canada, where marijuana has of course been legal at the national level since 2018, have described the Canadian market for cannabis beverages as “moving at a slower pace” vis-a-vis the U.S. market.[iv]

But hemp beverages may face a second headwind in states with legalized marijuana, beyond potentially reduced consumer interest: a not-entirely-supportive legislative environment, thanks to lobbying by marijuana companies. There is some reason to believe that, when marijuana is legalized, state legislatures are more likely to put up the “Caution” sign, if not the “Stop” sign, when it comes to easy access to hemp beverages.

It’s probably not surprising that some states have jumped in with efforts to regulate or even ban all intoxicating hemp products including beverages, especially in the cases of conservative-leaning states such as Texas or Georgia. What may or may not be surprising is that the governments of states with legalized marijuana are among the most negative toward marijuana’s less-potent fraternal twin. California currently has an outright ban in place, and while that ban is officially a temporary “emergency” measure, it’s not clear when or even if it may be lifted.[v] Among other marijuana-legal states, Massachusetts, Missouri, Maryland, and Alaska have either heavily restricted hemp-derived THC beverages or have tried to ban them outright.

Why? It would seem that no-one denies that some regulations are necessary to address health and safety concerns, whether in a more conservative state or in a marijuana-legal state. But some cannabis industry supporters believe that the latter states are motivated by hemp-derived THC’s potential role as a competitor to state-licensed cannabis dispensaries. As trade publication Beer Business Daily paraphrased a hemp industry spokesman, “…the traditional state-licensed THC industry…tend[s] to view delta-9 beverages as ‘wild west’ interlopers on the state-legal recreational model.”[vi] The Cannabis Law Now blog put it more directly, holding that marijuana-legal states “see these products as…in direct competition with the state-licensed cannabis industry.”[vii]

All of this could suggest that, as more states legalize recreational use of marijuana, the sales of hemp-derived THC beverages could actually face multiple potential barriers as a result of that legalization, in terms of both reduced consumer demand and new regulatory barriers.

Many people assume that states that have lagged in terms of marijuana legalization will eventually catch up, or even that recreational marijuana will become legal at the federal level. This may well be likely. But it’s not, as many believe, inevitable.

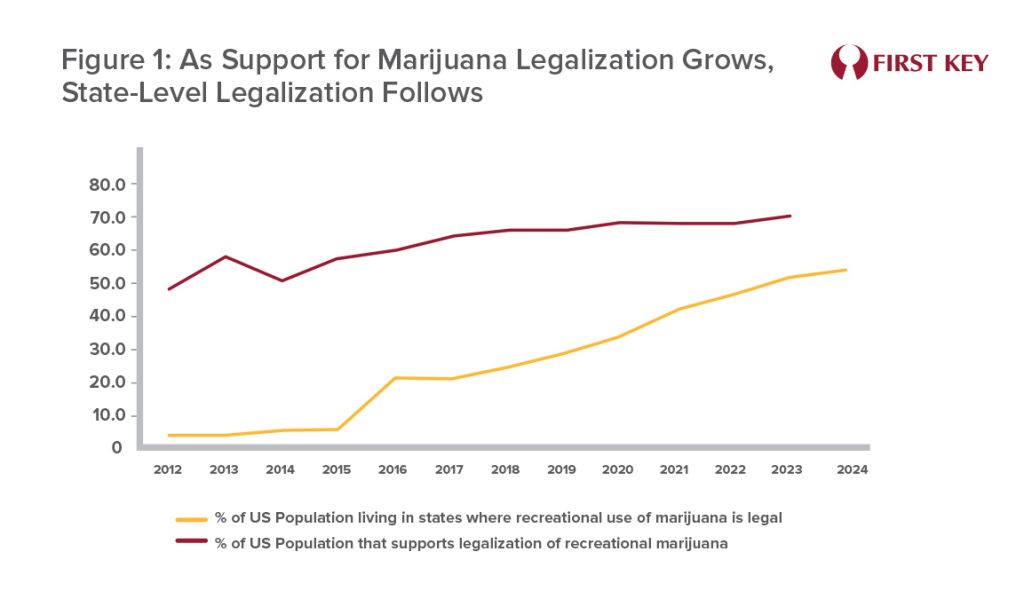

Over half of the U.S. population now lives in a state where recreational marijuana is legal. Meanwhile, polls show that public support for legalization is at 70% and growing. (See Figure 1, below.) Not surprisingly, growing public support seems to lead legalization (and a statistical analysis tends to back this up). Since 2012, when Washington and Colorado became the first states to legalize, that expansion of public support across the nation has been a significant basis for more and more states pushing the legalization button.

But what if the future of legalization (whether federally, or state-by-state) isn’t as rosy as supporters seem to anticipate?

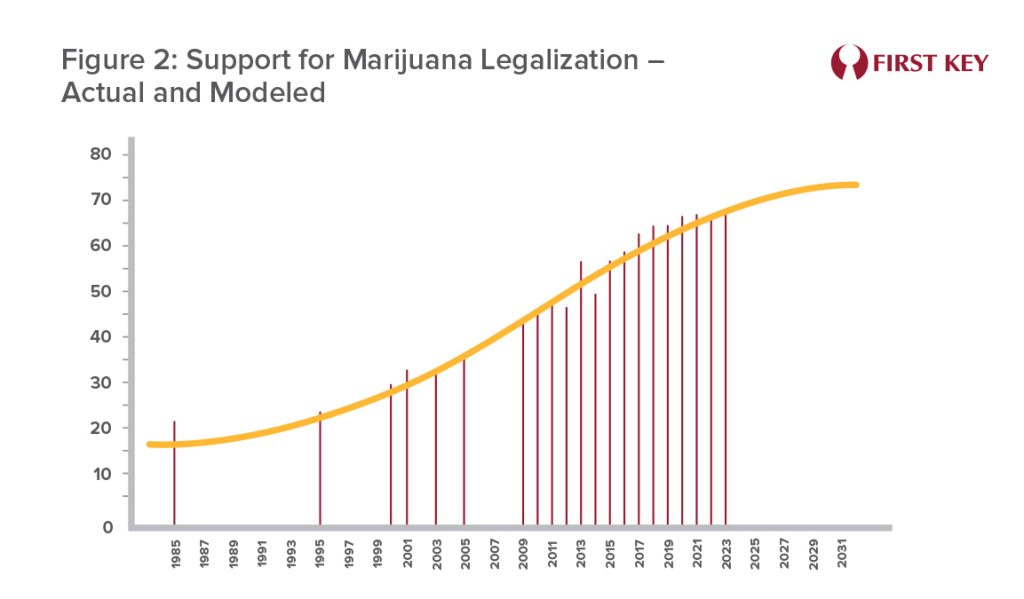

Looking at the long-term trend, starting in 1985 the growth in public support for legal marijuana follows a classic “S-curve” with a high degree of precision. (See Figure 2, below.) An S-curve – so-called because it resembles a flattened, elongated letter “S” – is an excellent model for the growth trajectory of any phenomenon that spreads by social influence. Such curves start out in a phase of slow but gradually accelerating growth, reach a middle phase in which growth is rapid but ultimately begins to taper off somewhat, and then in its last phase tapers even more until it comes very close to flat. The latter is an indication that the phenomenon being tracked has reached its peak.

The bad news for marijuana enthusiasts is that this model makes it appear that public support for legalization is about to peak, possibly even in the next five years – probably at around 76%, just a few percentage points above the current figure of 70%. This potential plateauing of that support may in turn foretell difficulty getting traction for proposed legalization, whether at the federal level or in new states.

The good news, of course, is that a model is just a model, and the scenario it seems to sketch isn’t destiny.

But against the current backdrop, if something like the S-curve’s “prediction” does come true, the bad news for marijuana just might be good news for the hundreds of beverage companies pursuing the hemp-derived THC space. There may be greater consumer demand, and one less reason for state legislatures to take restrictive action against the category.

But, to the extent that there’s a sibling rivalry between the two sources of THC, that’s an artifact of how, when, and where each became selectively legal. It’s likely that those with a stake in either will become advocates for a more uniform set of rules for both. And ultimately, who knows? Maybe nationwide legalization will then be within sight – and brands like Ceria can once again become what they were originally intended to be.

[i] https://www.brewbound.com/news/blue-moon-creator-plans-release-line-thc-infused-non-alcoholic-beers/

[ii] https://www.deliveryrank.com/blog/ceria-interview

[iii] https://www.sightlines.news/analysis/hemp-beverages-thrive-on-geographic-opportunity

[iv] https://cultmtl.com/2024/10/a-tale-of-two-markets-the-rise-of-cannabis-seltzers-in-the-usa-vs-canada/

[v] https://www.forbes.com/sites/ajherrington/2025/03/12/california-extends-ban-on-hemp-products-with-any-amount-of-thc/

[vi] https://beernet.com/bbd/bbd-article/big-marijuana-coming-after-d9/

[vii] https://www.cannabislawnow.com/2024/02/whats-in-your-thc-beverages/#:~:text=A%20lot%20of%20these%20%E2%80%9CTHC,9%20THC%20infused%20into%20them