In recent years, disruptions to the beer market have been plentiful. One that is getting a lot of attention recently is the seeming lack of vitality of the craft beer category. Craft beer sales took a hit during the pandemic and only partially recovered in 2021; now, further declines may be on the horizon. [i]

Of course, within the craft category, there are still success stories, with the most prominent being the apparent no-end-in-sight rise of IPAs. We would suggest, however, that both the softening performance of craft as a whole and the surging share of IPAs within craft may both be traceable (at least in part) to a singular consumer trend: a newfound desire for simplicity, and simplified choices. Marketers will tell you that brands (or product categories or styles) rise or fall in proportion to their ability to solve a consumer problem. In fact, in the last decade we may be seeing the reemergence of a new/old consumer problem: information overload, or the paradox of choice. And it’s a problem that IPAs may be better positioned to solve than craft beer more generally.

In his 2004 book The Paradox of Choice, psychologist Barry Schwartz asserted that when people are confronted with too many choices, their response is often essentially to shut down and make no choice at all. In theory this state of affairs should have been anathema to the growth of craft beer, since the category presents the beer drinker with a seemingly overwhelming number of choices. Yet, for various reasons, craft beer drinkers of the time seemed to be immune to the paradox of choice; rather than “shutting down” in the face of the multiplicity of choices offered by craft brewers, craft drinkers happily consumed a variety of choices, and the numbers of craft drinkers grew even as the number of choices grew.

However, in 2004 Millennials were in their 20s and Gen Z had yet to emerge from toddlerhood. Today, Millennials are middle-aged, and Gen Z is the newly emerging young adult generation. And both generations have helped pioneer a newfound desire for simplicity in daily life.

The Kantar MONITOR is the country’s longest running study of Americans’ attitudes, values, and behavior, and it sheds some light on how today’s preponderance of choices is viewed by younger generations compared to older cohorts.

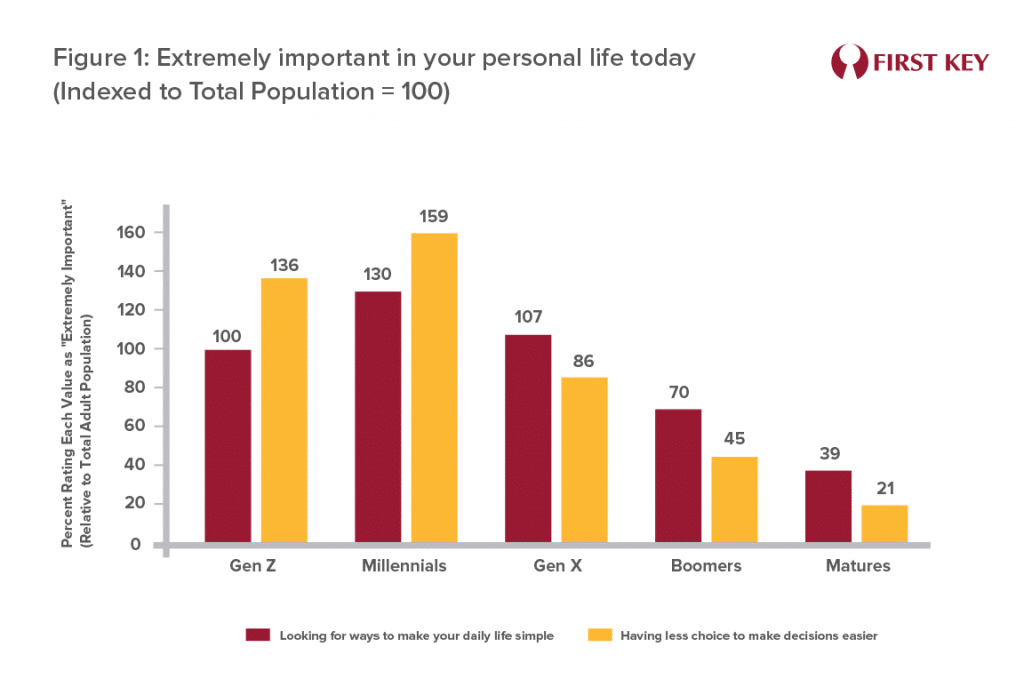

Figure 1 displays an analysis of responses to two questions posed in the most recent version of the MONITOR study. People were asked how important various aspects of their lives were to them, including “Looking for ways to make my daily life simple” and “Having less choice to make decisions easier.” The graph portrays those who said “extremely important” to each question, indexed to the overall total. In other words, looking at the graph, the typical Gen Zer was 36% more likely than the average adult to say that having less choice was extremely important to them.

Millennials lead the way in seeking simplification and less choice, with indices of 130 and 159 respectively, followed by Gen Z. Older generations are far less likely to find these aspects of life extremely important to them. It would appear that life seems far more complicated to younger adult generations than to their older counterparts.

The reasons for this are many, though not that relevant to our point here.[ii]

So, have perceptions of craft beer as “too complicated” grown in recent years? Craft has long endured such views from those outside the category, with examples ranging from the well-known 2014 New Yorker cover portraying a waiter and two craft drinkers oozing hipster affectation, to the 2015 Budweiser Super Bowl ad touting that their beer was not brewed to be “fussed over.” The craft beer community has generally ignored or rejected these criticisms.

But with a growing need for “less choice” and simplification among younger generations, perhaps a threshold has been crossed. Could craft beer volume be slipping because those perceptions of being “too complicated” are starting to wear some drinkers down?[iii]

Evidence of this may be seen in a perhaps surprising place – the rise of IPAs. There has been a sense for a few years that the dynamic behind the growing share of IPAs has been somewhat different than the historical growth drivers for craft. This author conducted a qualitative study a few years ago that supported what many of us may have observed more casually: many IPA drinkers are not particularly category-involved or brand-involved, and will simply order “an IPA” without concern for the brand – and many drink little or no craft beer other than IPAs.[iv]

For at least some drinkers, IPAs would appear to be a simplifying choice – an easy bar call that basically eliminates the need to get one’s head around the entire beer list.

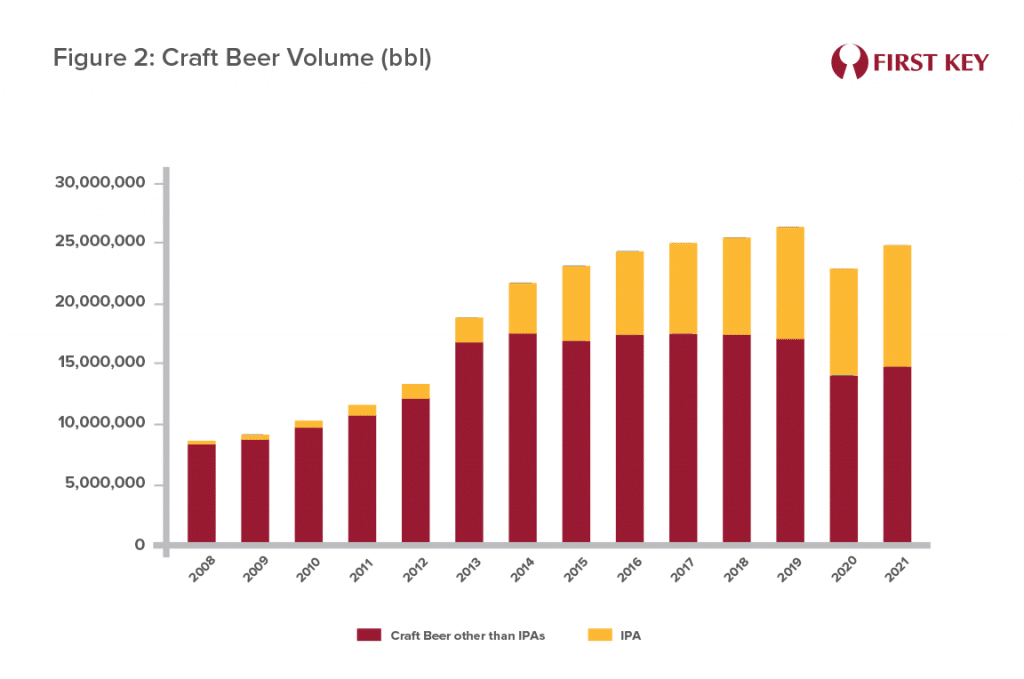

Figure 2 offers some perspective on this. Estimates of IPA share of craft over the years are provided by various sources, in particular IRI. We’ve used this to break down craft beer volume by year into the volume of IPAs and the volume of all other craft. The volume of craft beer other than IPAs actually peaked in 2014 at 17.4 million barrels, remained essentially flat for five years, and then declined in the last two years.

Clearly IPAs are not a separate category of beer whose performance should be segregated from other styles of craft – at least as a general rule. But with indications that a different dynamic may be driving some of IPAs’ growth among some drinkers, it may not be inappropriate to say that the success of IPAs may have been masking weakness in the craft category as it’s historically framed, for longer than we may have realized. The more IPAs proliferate, the more they become an uncomplicated choice in a sea of complicated choices – leading to the style’s further proliferation. It makes for an easy bar call among drinkers who may be weary of all the information overload and potential decision paralysis he or she experiences, not just in beer, but in all aspects of life today.

What might the future hold? As usual, understanding Gen Z’s attitudes and motivations will be a critical input in addressing that question. Simplification is seen by many generational analysts as a core Gen Z motivation – and therefore a trend likely to gain momentum as more members of Gen Z enter their adult years. For example, Inc Magazine, in a piece entitled “Marketing to Gen Z: Here’s What You Need to Know,” declared “They [Millennials and Gen Z] are both early adopters of all things that simplify their lives.[v]” And a McKinsey retail insights piece concluded that “Companies will have to innovate faster, reduce complexity, and simplify the product portfolio.[vi]”

Of course, simplifying consumers’ decision processes doesn’t necessarily require an even more determined focus on IPAs, nor does it unambiguously mean brewers will have to cull their portfolios. “Simplification” might be better described as taking a more strategic, structured approach to developing a portfolio, where every style has a distinct, relevant, and clearly communicated reason-for-being – making it easier for drinkers to get their heads around their options. Brewers who are successful in that regard will likely benefit from a consumer trend that seems to be gaining momentum every day.

By Mike Kallenberger – Senior Advisor, Marketing Insights and Strategy

References

[i] Beer Business Daily, July 13, 2022, “Craft’s Decline in Scans ‘Expected’ or ‘Alarming’?”

[ii] We would point out, however, that a generation’s overall worldview is heavily influenced by the state of the world when they’re younger, and that Millennials and Gen Z spent their formative years enduring the worst global economic crisis since the Great Depression, increasingly frequent headlines about mass violence, and then the Covid 19 pandemic. This is not to say older generations weren’t affected by any of this, but rather that these events did not have the same profound impact on the worldviews of those who experienced them as adults.

[iii] Note that, in the mid-2010s, craft drinkers had to sort through the options offered by just under 5,000 breweries. Now those drinkers are confronted with a “menu” of the products of over 9,000 brewers. Of course, most of those breweries’ offerings are available only in limited geographies, so no one drinker was literally confronted with that many choices. But these numbers illustrate the growing complexity faced by a would-be beer purchaser.

[iv] “A New Breed of IPA Drinker,” Mike Kallenberger, The New Brewer, September-October 2018

[v] https://www.inc.com/ryan-jenkins/marketing-to-generation-z-heres-what-you-need-to-know.html

[vi] perspectives-on-retail-and-consumer-goods_issue-8.pdf (mckinsey.com)