Caitlin Braam understands the cider industry at its core. She’s spent nearly a decade in the business of fermented apples, first as the president of Seattle Cider Company and then as a brand strategist for Angry Orchard. Upon founding Yonder Cider in Wenatchee, Washington, during the uncertainty of 2020, she was certain about one business decision.

“I didn’t want to open a cider-only taproom,” Braam says. “You’re usually only speaking to cider drinkers.”

To seed new cider drinkers, she partnered with Bale Breaker Brewing to create a co-branded taproom in Seattle’s brewery-rich Ballard neighborhood. The airy, patio-equipped taproom opened in September 2021 with 32 taps evenly split between Bale Breaker’s hop-forward pale ales and IPAs and Yonder ciders like Sunnyslope, inspired by the grapefruit-packed greyhound cocktail.

The shared menu entices drinkers to try something new, maybe the latest hazy IPA alongside a seasonal cider seasoned with cranberries. “We do mixed flight boards, and we often see people get two beers and two ciders,” Bramm says. By collaborating with a brewery, “we’re able to introduce cider to a bigger group.”

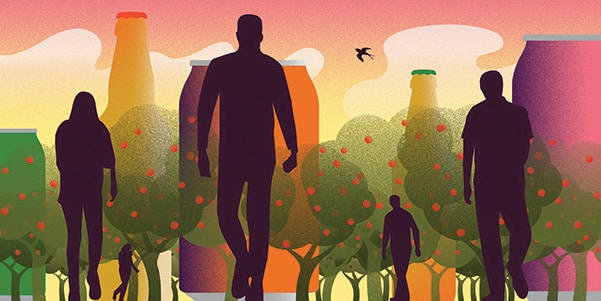

A half decade ago, hard cider seemed poised to return to its perch as one of America’s favorite fermented beverages. Cider’s centuries of history, ties to local agriculture, and gluten-free bona fides fueled its resurgence, cemented cider as an attractive beer alternative. Cider contained complexities, not just sweetness.

But then 100-calorie hard seltzers rushed in like a bubbly tide, drowning out cider’s gluten-free message, with “natural flavors” trumping anything derived from fruit. Ready-to-drink cocktails piled on, stemming the sales of national cider brands such as category leader Angry Orchard. (It’s owned by the Boston Beer Company, makers of Samuel Adams beers and Truly hard seltzers.)

Off-premise dollar sales for the Angry Orchard brand family hit $245 million in 2020, according to IRI-tracked data, down around $294 million in 2015. Molson Coors Beverage Company also discontinued its Smith & Forge and Crispin hard cider brands, knocking two more nationally distributed cider families from store shelves.

They didn’t remain barren. Instead, consumers embraced growing regional cider brands such as Bold Rock, Blake’s, and Downeast. “In 2020, independently owned regional cider brands became an equal player to combined national brands when it comes to cider retail sales for the first time,” Michelle McGrath, the executive director of the American Cider Association, wrote in an email. “In 2017, national brands owned by large companies were at least 75 percent of the retail share, so that reflects a big shift in the cider category.”

Retailers are increasingly bullish on cider too. During the recent CiderCon in Chicago, the global principle category merchant for beer at Whole Foods, Mary Guiver, said during a panel that she believes this is “cider’s moment.”

How will cideries seize the opportunity? As the category continues to evolve, cideries are doubling down on innovation and ABV, breaking cider free from its seasonal confines and entrenched associations with sweetness. There’s a creative windfall in the cider industry, and here’s how smart cideries are looking to take a bite out of the market.

Higher-Alcohol Ciders Lead to Huge Sales

Higher-alcohol beers are on fire, especially double IPAs such as New Belgium Juice Force (9.5 percent ABV) and Sierra Nevada Big Little Thing (9 percent ABV). Imperial ciders stronger than 8 percent ABV are also going gangbusters, with sales up 112 percent in Nielsen-measured retail channels as of early October versus prior year, according to an American Cider Association release.

The boom is partly due to a late-2020 TTB rule change. The government permitted wine producers (cider is regulated as wine) to package ferments stronger than 7 percent ABV in 12-ounce cans and bottles.

Stronger ciders “win on the shopper’s value equation, solving for both bold flavor and higher ABV,” Angry Orchard cidermaker Joe Gaynor wrote in an email. Last summer, Angry Orchard released the 8 percent ABV Hardcore Dark Cherry Apple, a strong entrant into a category led by 2 Towns Ciderhouse’s Cosmic Explorer and Schilling Hard Cider’s Excelsior lines of imperial ciders.

Schilling has been instrumental in popularizing imperial cider. The Auburn, Washington, cidery, which operates taprooms in Seattle and Portland, Oregon, first introduced its 8.5 percent ABV Excelsior Original Apple in 2018, later packaging it in six-packs of 12-ounce cans. “We developed that category for cider,”

As that brand accelerated, Schilling expanded its imperial line in 2021 by adding the 9.1 percent ABV Mango Supernova. “I actually told the sales team, ‘I don’t want you guys to sell it for the first month,’” says chief commercial officer Eric Phillips. He wanted to see how the market would market with an extra sales push “Within one month, Excelsior Mango was doing 75 percent of the sales dollars as Excelsior Imperial Apple.”

The company has since added a third imperial cider, the 8.1 percent ABV Red Glo. But Schilling also offers standard-strength ciders, including the semisweet Local Legend (5.2 percent ABV) and citrusy Grapefruit and Chill (6 percent ABV), helping reach “different occasions,” Phillips says.

Bold Rock, which has a production facility in Mills River, North Carolina, has traditionally played in cider’s sessionable range—around 4.7 percent ABV. Now the cidery is putting energy behind an 8.2 percent Imperial Cider that was released in August in six-packs of 12-ounce bottles. “We’ve seen a lot of great traction,” says senior brand manager Lindsay Dorrier.

Next spring, the company will launch its Imperial Cider in single-serving 16.9-ounce cans. “A standard 16-ounce can is not authorized,” Dorrier explains, and the next federally permitted packaging size is 25.4 ounces, or 750 milliliters. “We had to jump through some hoops to source the cans. They’re not produced domestically.”

The cans should land new sales slots in convenience stores, helping Bold Rock “get into new drinking occasions,” Dorrier says.

Focusing on Fruit Pays Off

Hard seltzer’s swift rise led some cideries to enter the fizzy fray. Citizen Cider uses hard cider to create the 100-calorie Citizen Seltzer line, and 2 Towns focused on fresh fruit in its SeekOut hard seltzers.

Texas-based Austin Eastciders made its Spiked Seltzer with a hard cider base. “It was a seltzer from a cider company,” says president and general manager John Glick. “When you walk up to the shelf and there’s a thousand choices, why pick this one up?”

Drinkers didn’t. Austin Eastciders ended the seltzer line and now focuses on a 100-calorie line of light ciders, including the dry Texas Brut and Mango Mimosa. The appeal lies in the calorie count and ingredient list touting fruit. “You know what’s in it,” Glick says.

Focusing on real fruit is the M.O. at Denver’s Stem Ciders, which builds ciders from an apple base that’s fermented dry with white wine yeast. “We essentially have a blank canvas that I can then paint flavors onto,” says Patrick Combs, the director of innovation and quality.

The neutral base lets Stem create for every customer desire, from 100-calorie Real Light to the spicy and tropical Chile Guava and Flockstar, made with watermelon, hibiscus, and cucumber. “We’ve seen that our brand has become much more accessible to drinkers because of our diversity of flavors,” says Tristan Chan, who does public relations for Stem.

Like a craft brewery, Stem makes lots of limited-edition releases, such as a pumpkin-spice latté cider and imperial ciders inspired by tiki cocktails like the Singapore sling. “That’s something that we’re excited to lean into and see what flavor profiles we can coax out,” Combs says.

Beer is a growing focus for Stem. In spring 2022, the cidery acquired the Howdy Beer “western pilsner” brand from Post Brewing and opened the Howdy Bar taproom. It aligns beer with whiskey and ciders, offering customers all beverages in one drinking occasion. Next spring, Stem will court IPA drinkers by blending cider with hops and apricots to “re-create a hazy IPA in cider form,” Combs says of the apricot and hop . “It doesn’t really drink like a cider.”

Thinking like a brewery saved Lost Boy Cider. Tristan Wright opened his cidery in Alexandria, Virginia, in June 2019, and had no distribution when the world paused in spring 2020. As an economic lifesaver, Wright started canning around 350 19.2-ounce cans of cider weekly, selling them for $10 apiece during curbside pickup. “It was keep-the-lights-on stuff,” Wright says.

To keep customers returning, Lost Boy created a dizzying array of different ciders. “We made 123 unique ciders that year,” Wright says. Now, Lost Boy’s monthly Explorer series features a unique cider packaged, beer-style, in four-pack of 16-ounce cans. Explorer releases might channel pickles, margaritas, or even a märzen lager, creating a cider suited for Oktoberfest. “The Explorer series gets people talking about what cider can be,” Wright says.

Great label designs and branding are also key. In years past, many cideries leaned into agricultural imagery, the labels decorated with lush trees and shiny red apples. Yonder’s clean, typography-driven labels intentionally avoid apples and trees. “If it screams cider, people assume they don’t like cider,” Bramm says.

Schilling’s labels feature colorful, anthropomorphized animals, a veritable zoo of cider-loving creatures. “We shop with our eyes,” Phillips says. “Drinking should be fun and enjoyable, so the approach was to be inclusive and allow more people to be a part of the conversation.”

Cider is ripe for reinvention, and a new generation is looking for beverages that might be the apples of their eyes. Smart cideries will find what works well in their region and run with it. For its part, Austin Eastciders is looking into experimenting with native plants, while Yonder serves single-varietal ciders made from Washington State apples alongside cider blended with locally made amaro.

“We want to help people think about cider in a different way,” Braam says.

By Josh Bernstein