It is fair to say that when the Millennial Generation entered its prime drinking years, back in the early 2000s, they altered the alcoholic beverage landscape in dramatic ways.

They favored spirits and wine over beer, in ever-increasing numbers. But they also rallied the craft beer business from a period of anemic growth that had been hanging on for the better part of a decade. Their tastes and preferences were arguably the number one influence on the shape of the beer market that has emerged today.

And now, with adult Gen Z’ers in the early years of their drinking lives (ages 21-23) people are already wondering if this generation will have a similarly dramatic impact. Several industry experts and observers have cited data and more generalized evidence that this generation is less inclined to drink alcohol than were prior generations in this same life stage.[i]

Some new data from the Kantar U.S. MONITOR[ii] survey not only supports those indications, but the shifts it also portrays are starting to look fairly dramatic. In particular, Gen Z appears to be producing far less than its fair share of alcoholic beverage drinkers. Not only their behavior but their attitudes and values strongly suggest a cohort with far less affinity for drinking than any youth generation coming of age since we’ve measured these sorts of things. And of all the various beverage types, craft beer may be taking the brunt of Gen Z’s indifference.

Of course, it’s still early in the Gen Z era, and so any reaction should be tempered at this point. Yet these recent numbers appear to be much more than blips. For some trends that have been on the rise during the Millennial era, the pendulum may have started to swing back.

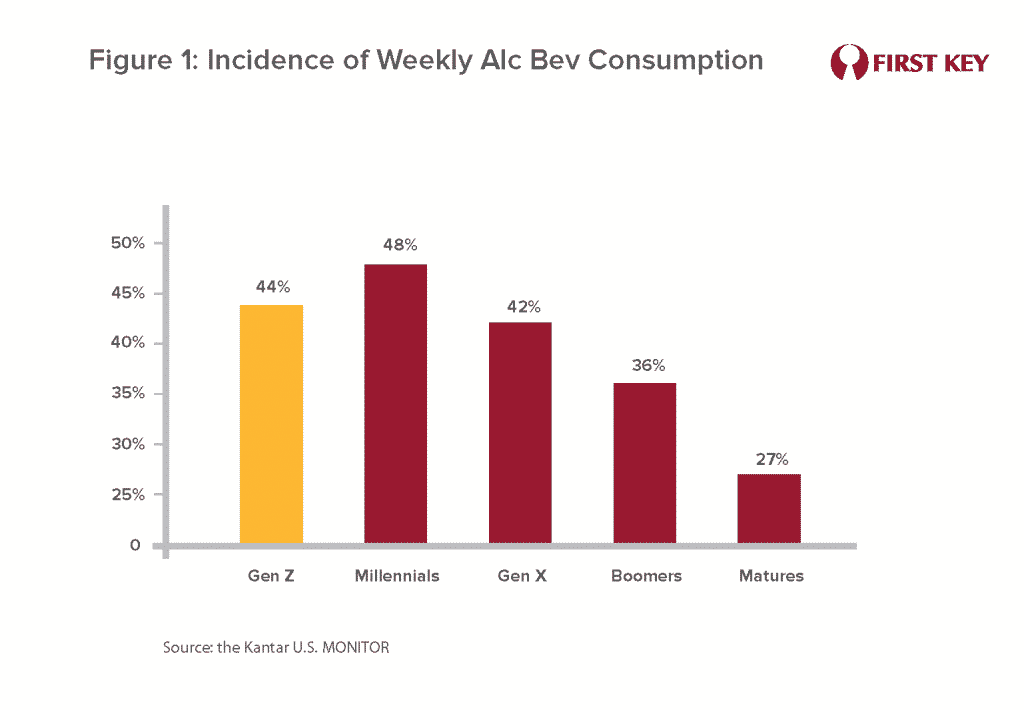

Figure 1 presents data from the 2020 iteration of the U.S. MONITOR study. In at least one key respect, what it shows is unprecedented: no emerging 20-something generation has ever been less likely to drink alcoholic beverages than older drinkers. Yet this is in fact true of Gen Z. Only 44% of 21-23 year-old Gen Zers say they drink at least one alcoholic beverage a week, compared to 48% of Millennials (who are currently between 24 and 41). Of course, the more apt comparison would be to Millennials when they were 21-23. We don’t have those figures, but given the way incidence typically drops off with age, it’s fair to guesstimate that Millennials’ incidence rates at ages 21-23 were in the low to mid-50s. That would mean a fall-off of six to ten percentage points from the Millennial era to the Gen Z era.

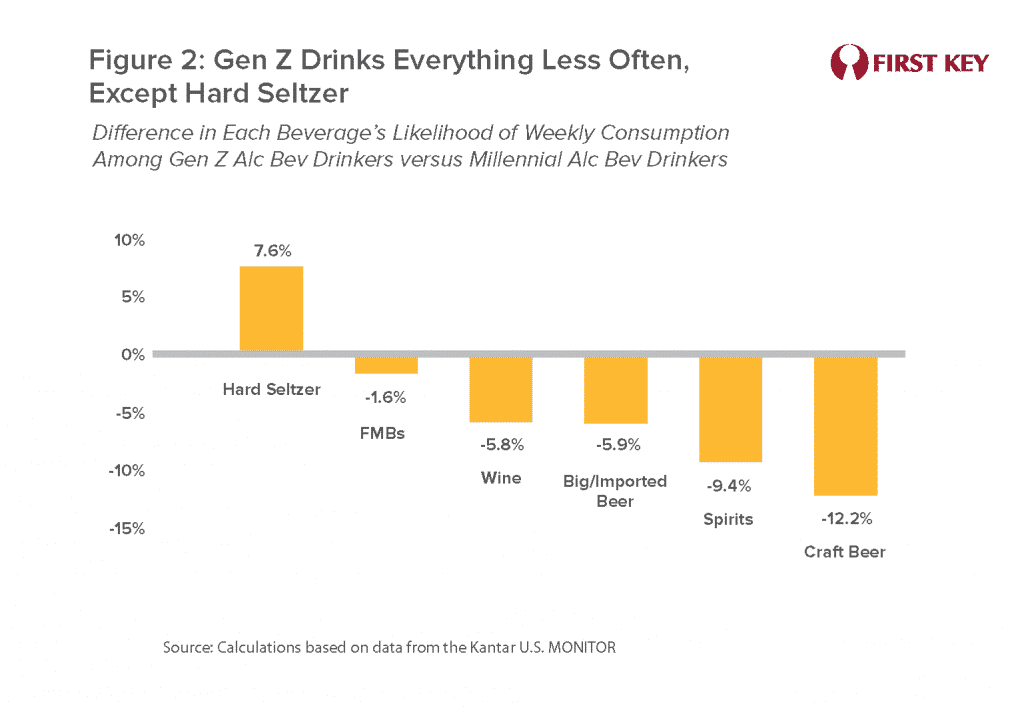

What is even more noteworthy is that Gen Z’ers are less likely to be weekly beer drinkers even after we account for the drop-off in overall drinking. Even among those who do in fact drink alcohol weekly, Gen Z’ers are 6 percentage points less likely than Millennials to drink “big or imported beer” and 12 percentage points less likely to drink craft beer on a weekly basis. (Figure 2)

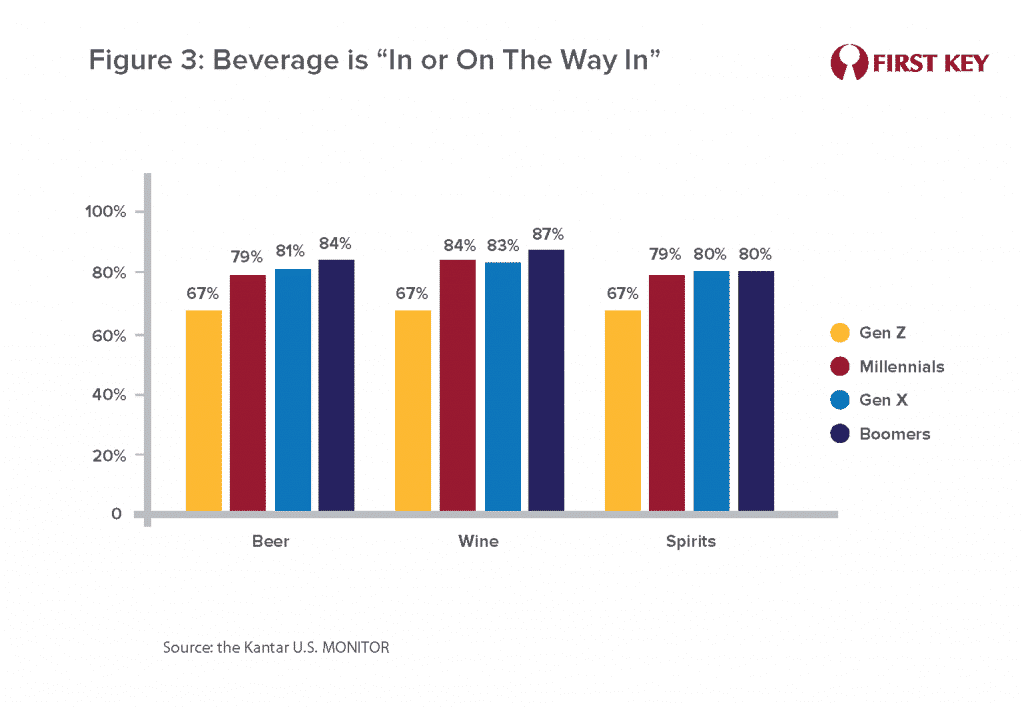

In addition, individual Gen Z’ers recognize that their peers largely feel the same way. Figure 3 displays data from the previous year’s MONITOR survey: while beer, wine, and spirits are seen as “in” by four in five members of older generations, only two thirds of Gen Z’ers bless any of the three beverages with that sort of social approval. Again, the ideal comparison would be between generations at the same life stage; yet this data is telling nonetheless.

What’s underlying all of this? The popular conception is that Gen Z is a very health-conscious generation, and this may certainly be playing a role. It could be argued that in Figure 2 the size of each beverage category’s drop-off is very roughly associated with perceptions of higher alcohol, or lack of health benefits more generally.

But it seems like there’s more going on. The evidence is increasingly sketching a portrait of a generation that, simply put, takes life more seriously at this stage of life than had previous generations. They may or may not view alcohol consumption as consistent with their more serious take on life.

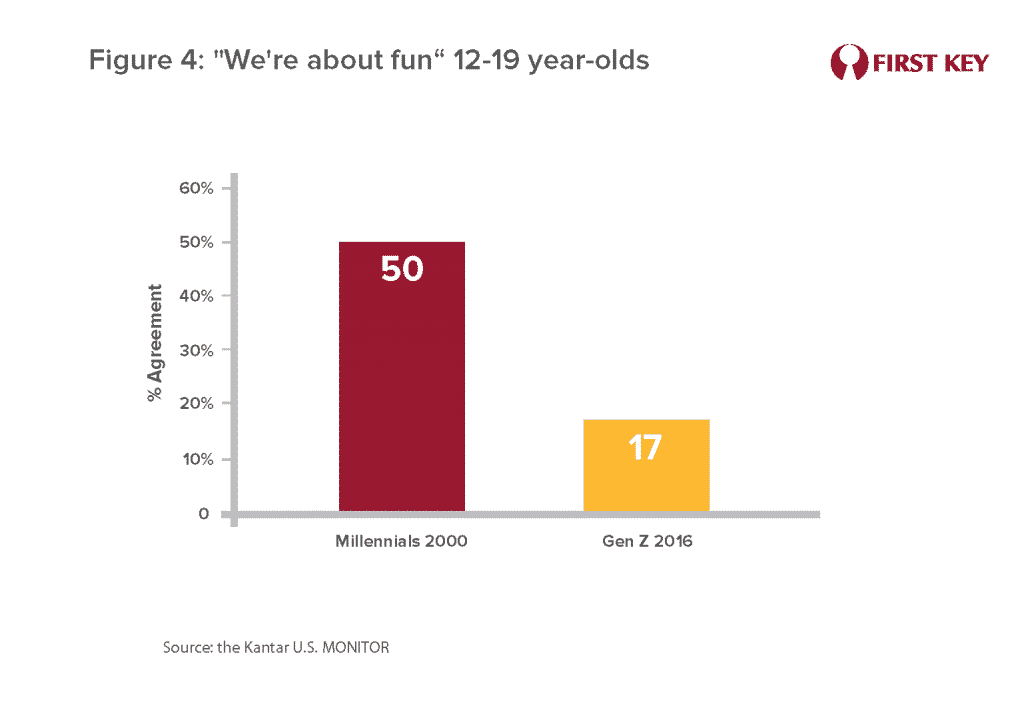

There’s one key data point regarding Gen Z which we can in fact compare to Millennials at the same age. Figure 4 displays MONITOR data from 2000, when Millennials were 12–19-year-olds, and from 2016, when that age range was occupied by Gen Z. Exactly 50% of teenage Millennials agreed with the statement “We’re about fun.” Sixteen years later, only 17% of teenaged Gen Z’ers shared that self-image. This is a staggering difference in perspective barely a generation later.

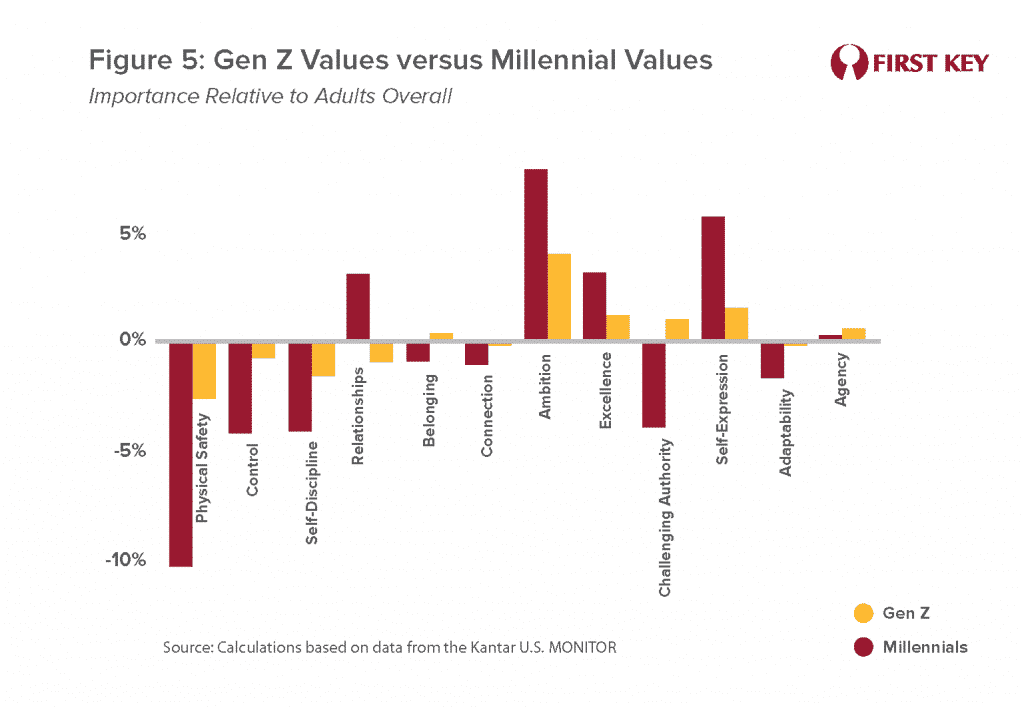

The 2020 MONITOR also asked respondents to rate the importance of a series of values in their lives today. Kantar has broken out the answers by age, which we used to construct a “values profile” for each generation. Figure 5 compares the importance of each value for Gen Z’ers and Millennials, relative to adults more broadly.

Once again, the differences are striking. True, Gen Z’ers are far less likely than Millennials to value physical safety, control, or self-discipline, but this is probably related more to their current age range than generational differences; most generations de-emphasize these values when they are young. Most youth generations also place a high priority on challenging authority. Not so Gen Z. For a youth generation they place an almost shockingly low priority on challenging authority.

Meanwhile, ambition, self-expression, and excellence are critical values for Gen Z (as are one-on-one relationships). This is a characterization we might have assumed to be more applicable to an older generation, but Gen Z’ers express these values more often than do Millennials. If they are not about fun, Gen Z may well be about success.

How did they get this way? The formative experiences of Gen Z’ers were dramatically different than those of young Millennials. In the 1990s and 2000s, when Millennial kids first reached an age old enough to be cognizant of the world beyond their immediate experience, the U.S. was in an optimistic state of mind. The Berlin Wall had fallen, and the world was seemingly opening up to ideals of freedom and human potential. The tech boom was driving a prosperous economy. By the time of the Great Recession 2008-09, Millennials’ worldview had already taken root, leaving their optimism battered but not broken.

But that Great Recession hit Gen Z right when they were in their most impressionable years – as did the impact of terrorist attacks and school shootings and the advent of “active shooter lockdown drills” as a staple of the American school experience. Hypothetically, these are the sorts of events that helped to teach Gen Z that life needed to be taken more seriously.

But what’s next for Gen Z – and this gravitas aside, for beer?

Beer has long played a role as a reward or a celebration of success. Some powerful beer brands have been built by positioning themselves as the epitome of just that. Think of Miller Time in the 1970s, or This Bud’s for You in the 1980s. More recently Michelob Ultra and Modelo Especial have staked out claims to similar turf. It may not be a coincidence that in 2019 these two brands continued their run as the decade’s two biggest gainers, with respective growth rates of 15.9% and 15.0% versus 2018.[iii] That sort of positioning is most motivating to those who value things like ambition and excellence, which appears to be exactly how Gen Z’ers see themselves.

Nevertheless, there is a long road ahead for this generation. Ten years from now the leading edge of Gen Z will be 33, and those in their 20s will be people who have not even been surveyed as of 2021 having not yet entered adulthood. They won’t resemble Millennials but they may not much resemble themselves as 21-year-olds either. Gen Z just might decide they’re about success and fun after all.

[i] Formerly known as the Yankelovich MONITOR, the study is the longest running survey of Americans’ attitudes and values. Kantar is a major data analytics and brand consulting company.

[ii] See, for example, https://www.brewersassociation.org/insights/gen-z-comes-of-age-with-new-preferences/ (BA membership required)

[iii]https://www.usatoday.com/story/money/2020/03/18/the-most-popular-beer-brands-in-america/111416118/ using data from Beer Marketers Insights.